This is our most up-to-date report on global contactless payments, featuring verified figures and forecasts from leading industry sources.

It covers everything from market growth and adoption rates to regional patterns and technology trends shaping how consumers pay today.

We’ll begin by highlighting this year’s headline statistics on the size, reach, and impact of contactless payments across the world.

Now, let’s explore the data.

Data Sources And Methodology

This article combines open-access resources and proprietary data to present accurate, up-to-date statistics and trends on contactless payment. Our methodology involves:

- Aggregating data from government databases, industry reports, and academic publications

- Incorporating exclusive insights from leading industry providers

- Regular updates to reflect the latest information

Key data providers include:

Key Takeaway

- The contactless payment terminals market will triple to USD 43.4 billion by 2026.

- Global contactless payments are projected to reach USD 140 billion by 2029.

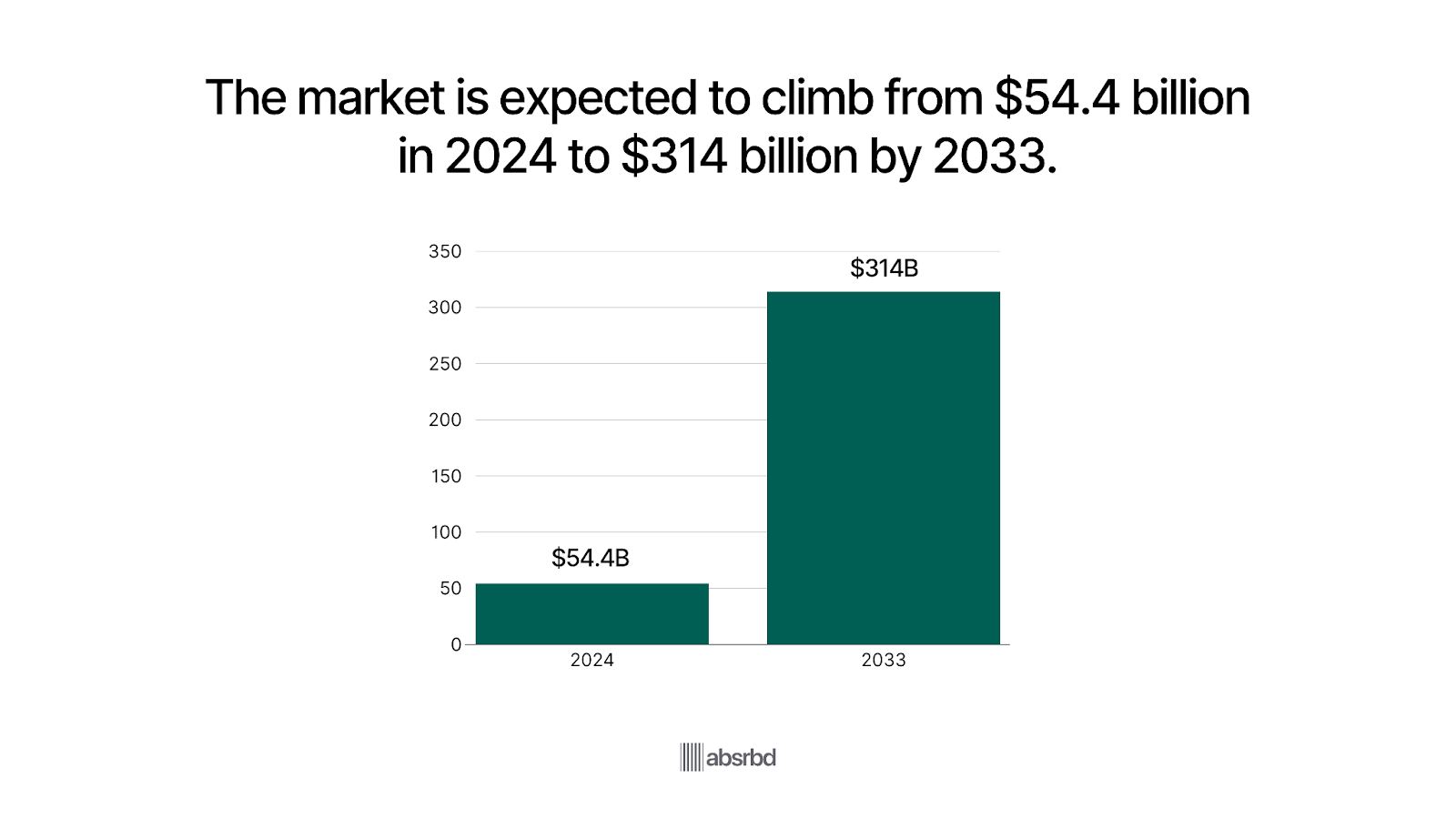

- The market could surge to USD 314 billion by 2033, growing around 21% annually.

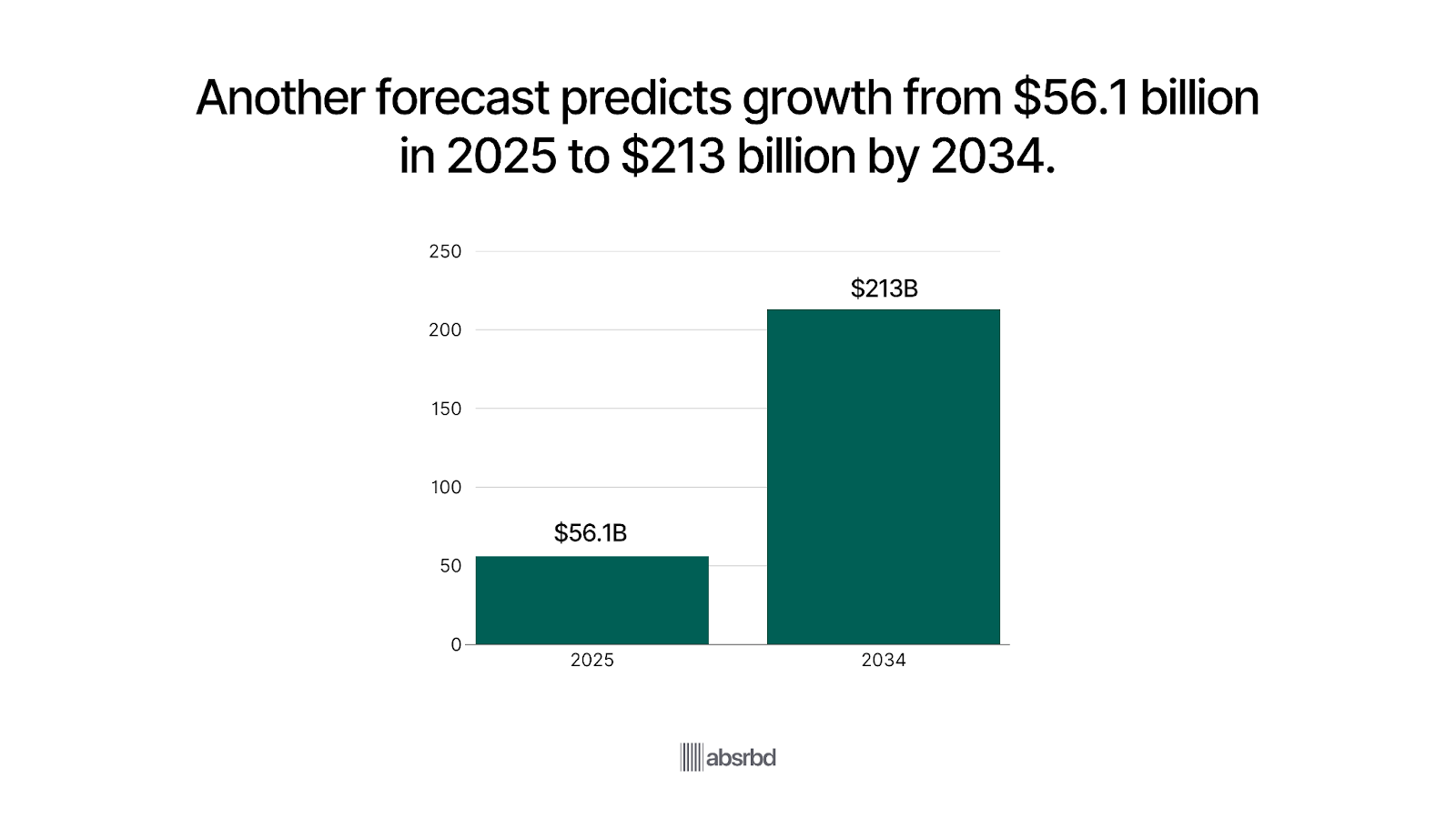

- Long-term forecasts place the market at USD 213 billion by 2034.

- About 70% of all in-person transactions worldwide are now contactless.

- Nearly half of Americans spend more when using digital wallets.

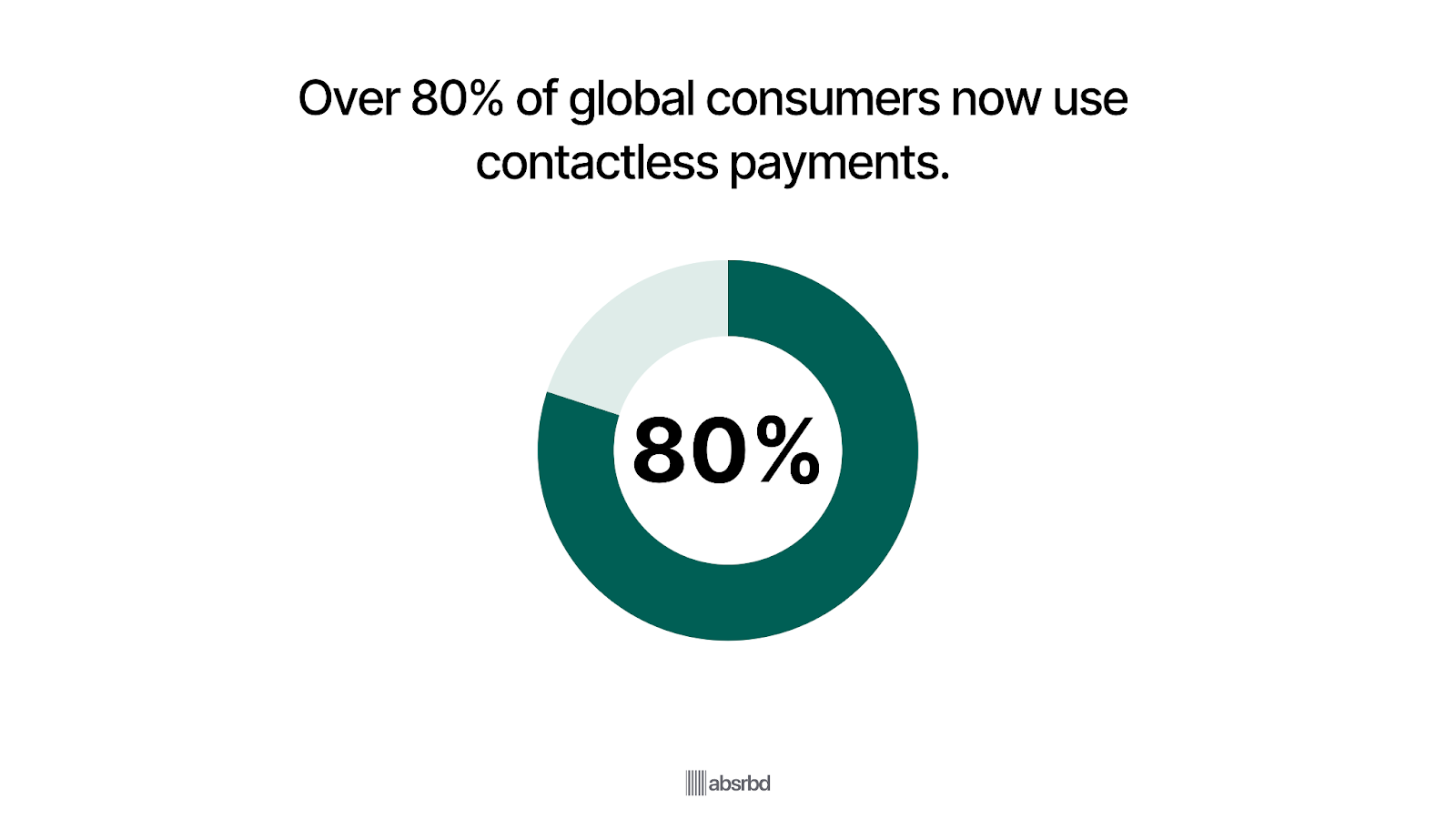

- Over 80% of global consumers now use contactless payment methods.

- There are more than 290 million POS terminals operating worldwide.

Overview of Contactless Payments

Contactless payments emerged in the early 2000s, driven by advancements in Near Field Communication NFC technology and the growing demand for faster, more convenient payment solutions. This method allows consumers to make transactions by simply tapping their card or mobile device near a point-of-sale terminal, eliminating the need for physical contact.

In 2024, the global contactless payments market was valued at USD 57.85 billion, and it is projected to grow sharply into 2025, reaching USD 70.08 billion CAGR 21.1%. By 2026, contactless especially NFC-based revenues are expected to cross USD 41.1 billion, split across hardware, solutions, and services segments hardware USD 20.6B, solutions USD 11.7B, services USD 8.9B.

Adoption is widespread: NFC powers over 95% of contactless transactions globally and is the dominant technology behind the tap-to-pay surge. In Europe, nearly 85% of retail transactions are now contactless, a figure expected to inch toward 90% by 2025–2026.

Meanwhile, in the U.S., contactless payments account for 58–65% of in-store digital transactions, depending on retailer and device adoption levels. This growth reflects more than convenience. As consumers increasingly favor digital wallets and one-tap payments, direct card use i.e. swiping, inserting is ceding share to wallet-based transactions.

Digital wallet penetration is exploding: over 5.3 billion people globally now use wallets such as Apple Pay or Google Pay by 2025, and these apps are expected to handle trillions in transactions by the late 2020s.

The infrastructure side is evolving too. POS terminals supporting NFC are now standard in many markets, and wearables, smartcards, and IoT devices increasingly include built-in contactless capability. The hardware, solutions, and services layers of the contactless stack are scaling in tandem.

Despite strong gains, challenges remain: interoperability across regions, standardization, and rising security scrutiny are key hurdles. A recent academic study flagged multiple vulnerability vectors in EMV contactless systems card, authentication, authorization, reinforcing that implementation & protection quality matter greatly.

Key Statistics

- Contactless payment terminals market is expected to grow from USD 16.25 billion in 2021 to approx USD 43.42 billion by 2026, at a CAGR of about 21.8%. GlobeNewswire

- By 2029, that same report forecasts contactless payments will reach USD 140.55 billion globally. The Business Research Company

- A different source places the global market at USD 54.44 billion in 2024, with growth to USD 314.13 billion by 2033, assuming a CAGR of 21.5% from 2025-2033. Market Data Forecast

- Another forecast Precedence Research estimates the market will grow from USD 56.11 billion in 2025 to about USD 213.39 billion by 2034 at a CAGR of 16%. Precedence Research

- Mastercard reports that 70% of face-to-face transactions globally are now contactless late 2024. PYMNTS

- In the UK, 94.6% of eligible in-store card transactions were contactless in 2024. Barclays Home

- 47% of Americans say they spend more money when using digital wallets compared to traditional payment methods. Forbes

- Over 80% of consumers globally now use contactless payment methods up from 74% in 2022. CoinLaw

- The global installed base of POS terminals was 292 million units in 2023, with projected growth especially in emerging markets. Windpress

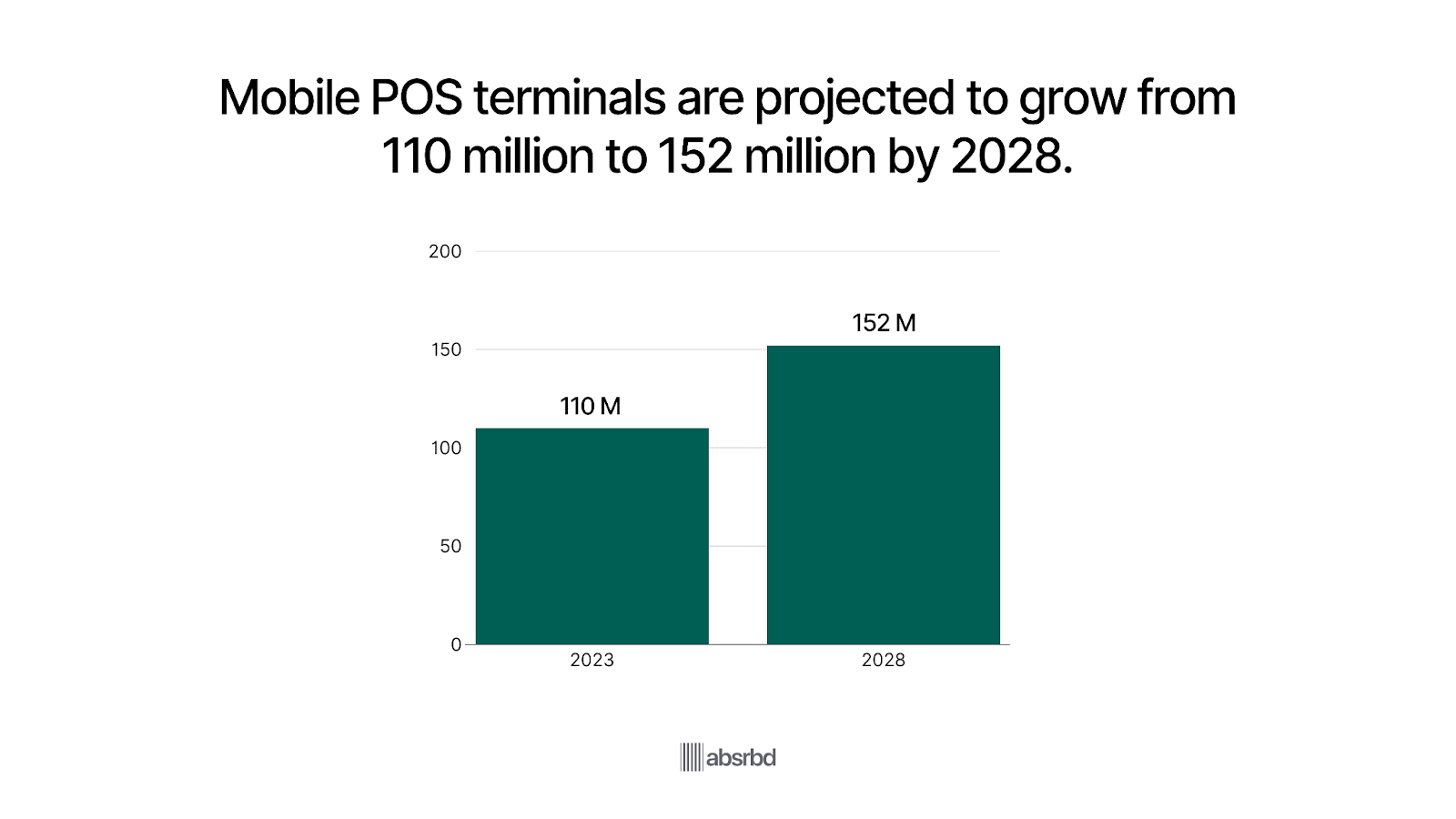

- Mobile-Point-of-Sale mPOS terminals are forecast to increase from 110 million units in 2023 to 152 million by 2028. Windpress

- The contactless payment terminals market hardware etc. was USD 34.23 billion in 2023, with forecasts to reach USD 124.43 billion by 2032 CAGR 15.42% from 2024-2032. Zion Market Research

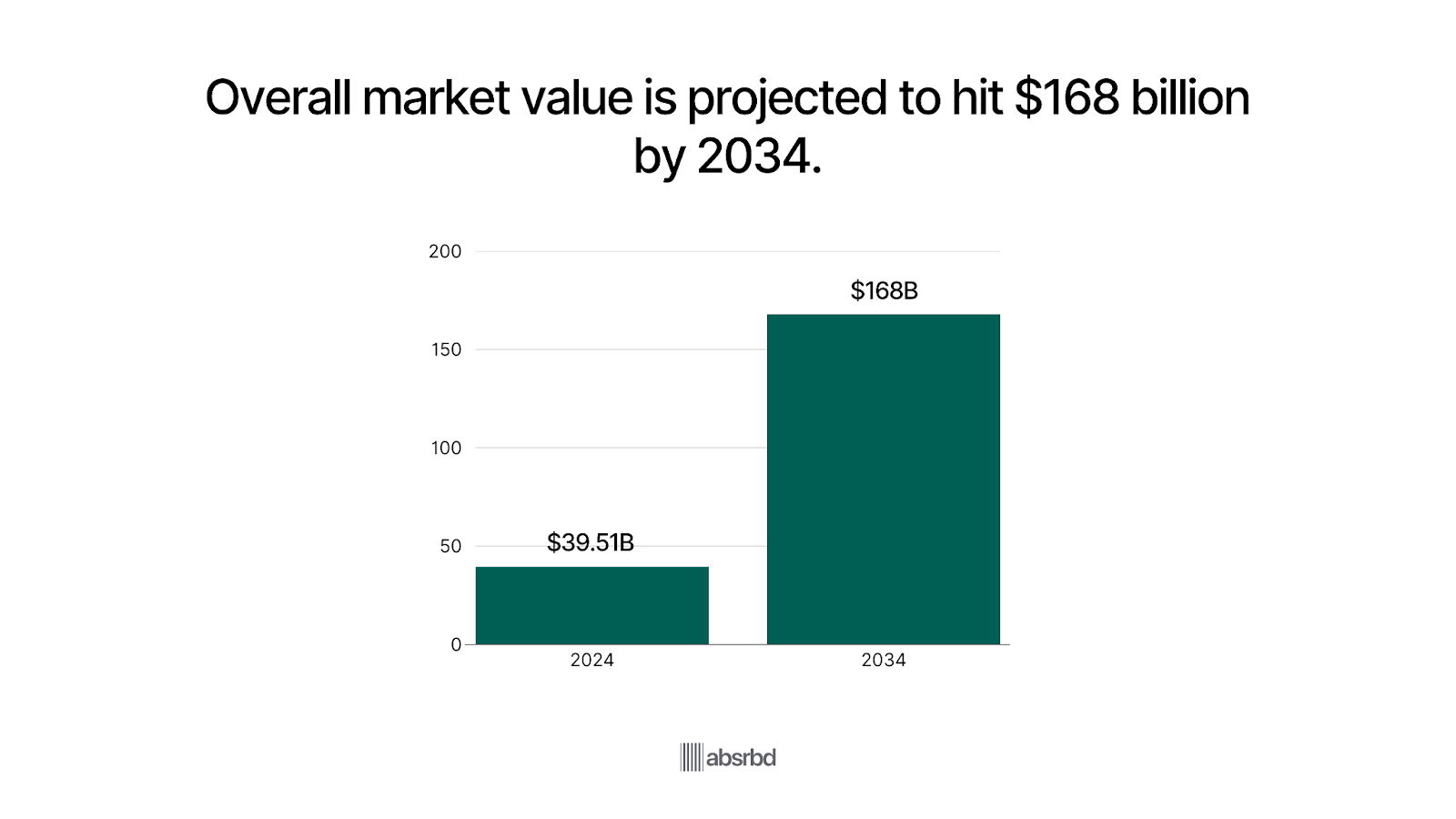

- The overall contactless payment terminals market size was USD 39.51 billion in 2024, and projected to increase to USD 168.38 billion by 2034, at 15.6% CAGR from 2025-2034. Fundamental business insights

- 51% of people say they would stop shopping with a merchant that doesn’t accept payments from digital wallets. Forbes

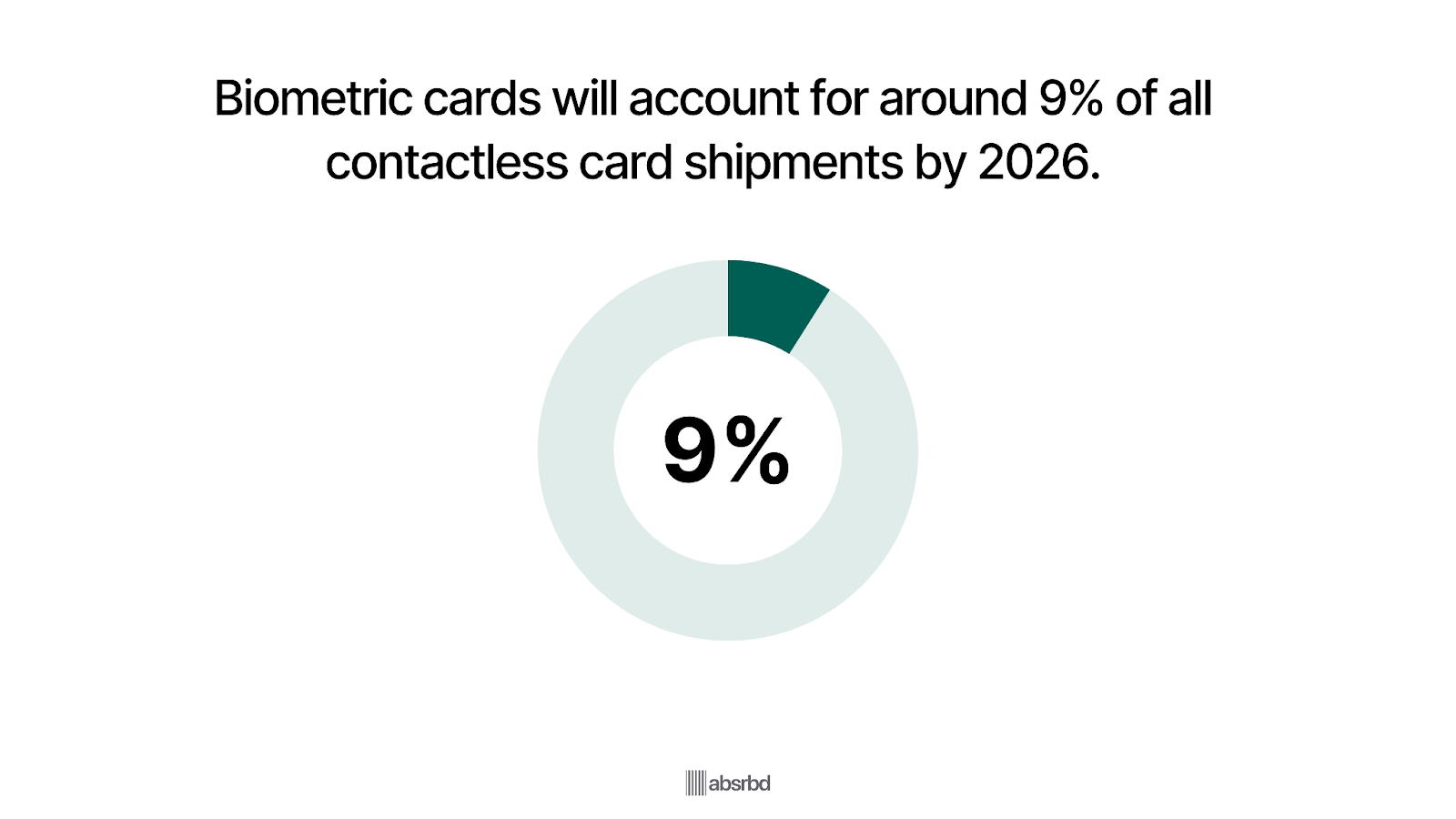

- Biometric payment cards are expected to represent up to 9% of annual contactless payment card shipments by 2026, with between 41-254 million biometric cards shipped worldwide. Cision

- The BFSI banking, financial services, insurance segment in the global contactless payment market is expected to exceed USD 1,827 million by 2026, growing at 10.6%. Research dive

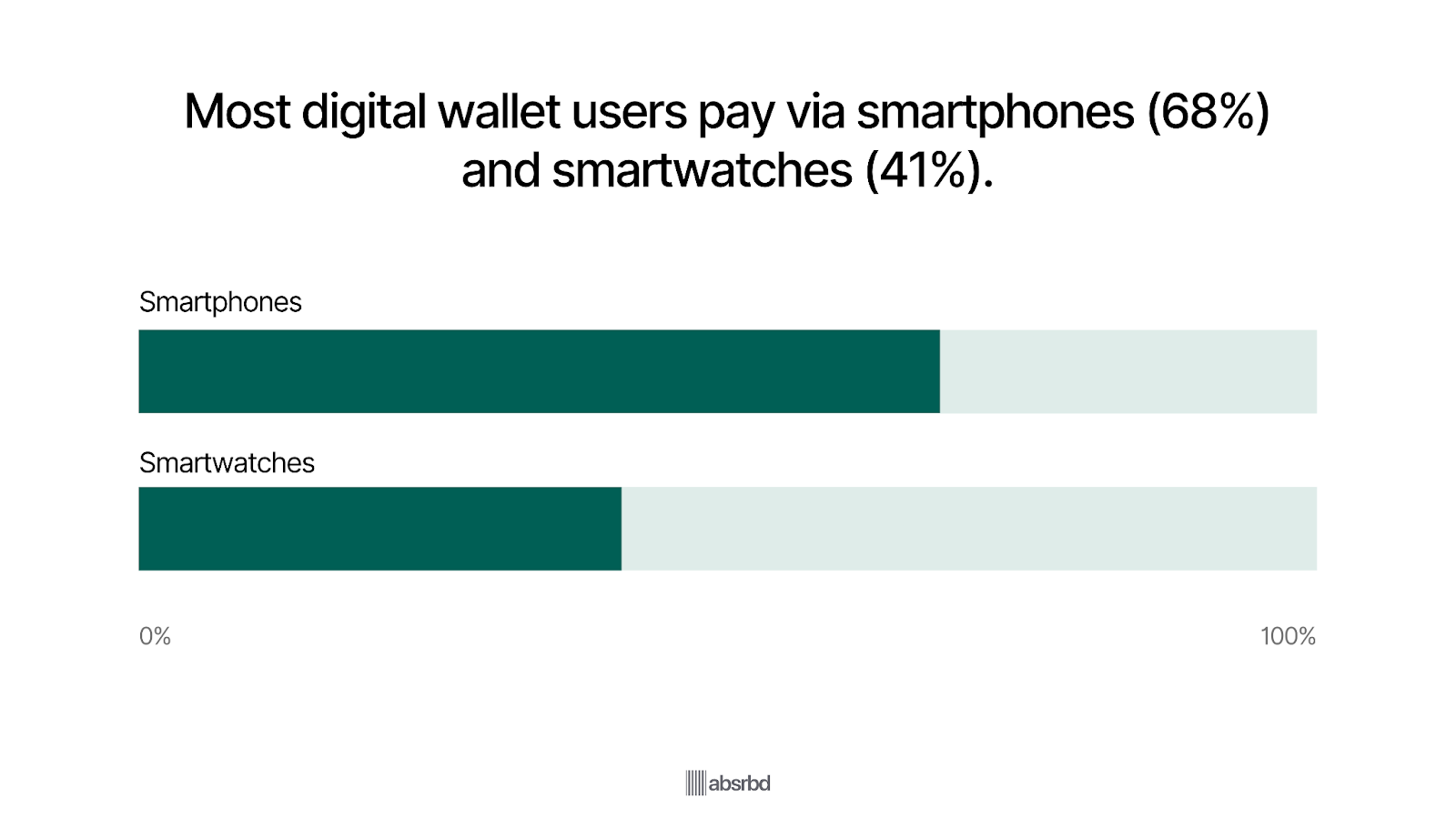

- Most digital wallet users access these services via smartphones 68% and smartwatches 41%. Forbes

- Over 70% of people said they would make digital wallets their primary method for shopping, while another 62% said they would for travel. Forbes

Major Trends in Contactless Payment

Contactless payments in 2026 are shaped by rapid technological innovation, growing consumer trust, and the global shift toward faster, more secure, and touch-free transactions.

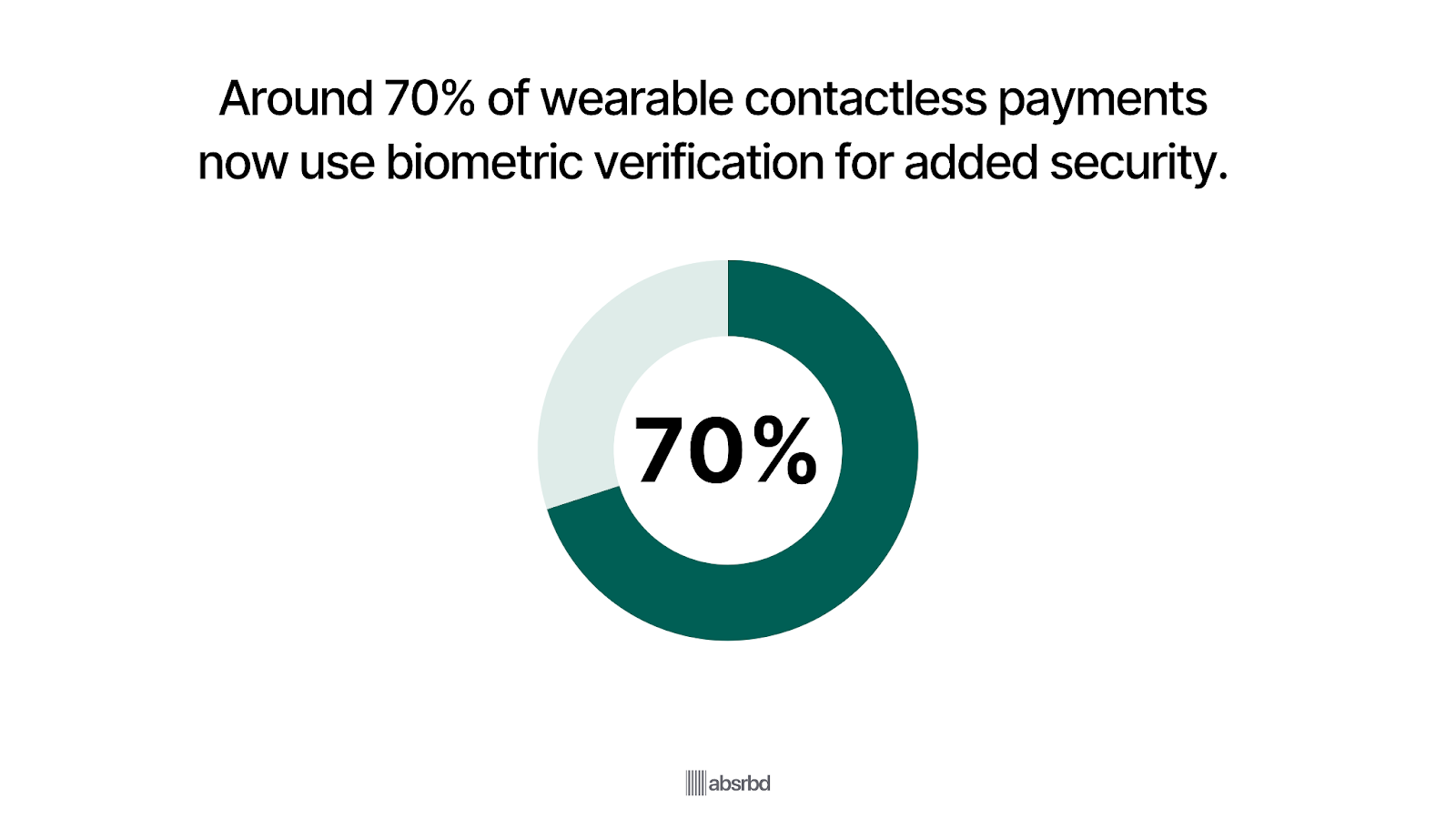

Biometric Authentication to Secure 70% of Wearable Payments Before 2026

Approximately 70% of wearable contactless transactions now use biometric verification such as fingerprint or facial recognition. Coinlaw

Tokenization technologies replace card data with one-time digital credentials, minimizing fraud risk.

These innovations are expected to accelerate trust and adoption across mobile and wearable payment ecosystems.

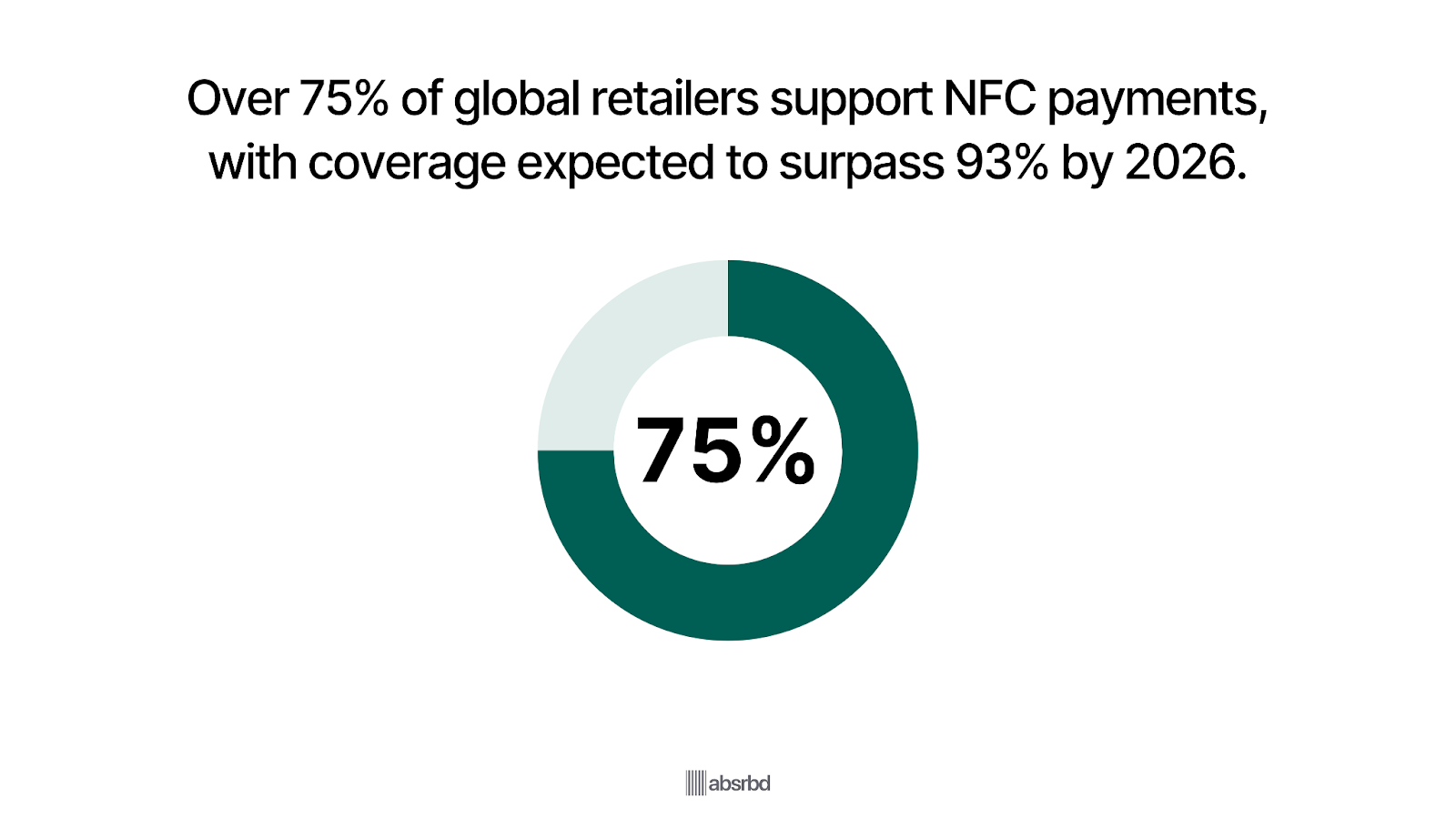

Nfc Enabled Terminals to Surpass 93% of Global Retail Locations by 2026

As of 2024, more than three-quarters of retailers worldwide have upgraded to NFC-compatible point-of-sale terminals, with coverage expected to exceed 93% by 2026. Business wire

Supermarkets and fast-food chains lead the trend due to their high transaction volumes.

Universal acceptance is making tap payments the default experience for consumers in developed markets.

73% of Millennials and 66% of Generation Z Are Embracing Contactless Payment Methods. Market US

The contactless payment market is heavily influenced by younger consumers, with 73% of millennials and 66% of Generation Z embracing these methods. Market US

This demographic shift indicates a strong inclination towards digital solutions, as younger generations prioritize convenience and speed in their purchasing experiences.

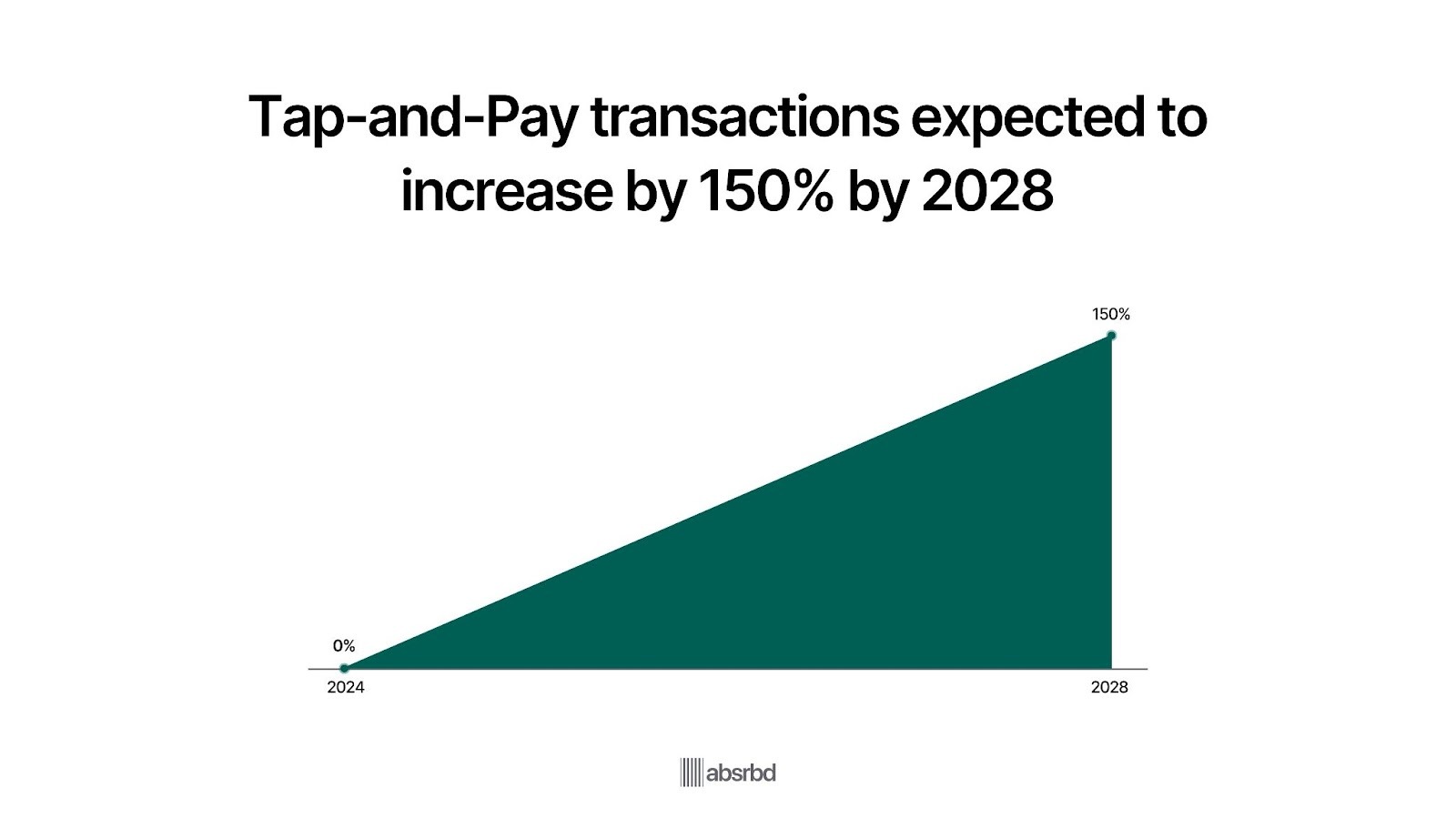

Tap-And-Pay Transactions to Increase by 150% in 2028.

The tap-and-pay method is rapidly gaining traction, with the global value of transactions via digital wallets expected to increase by over 150% by 2028. Consumer Finance.

This trend is significant as it reflects a shift towards convenience and speed in payment processing, enhancing the overall customer experience.

With nearly 99% of smartphones projected to support contactless payment capabilities by 2027, the prevalence of tap-and-pay technology is set to redefine consumer interactions at checkout points. Digipay Guru

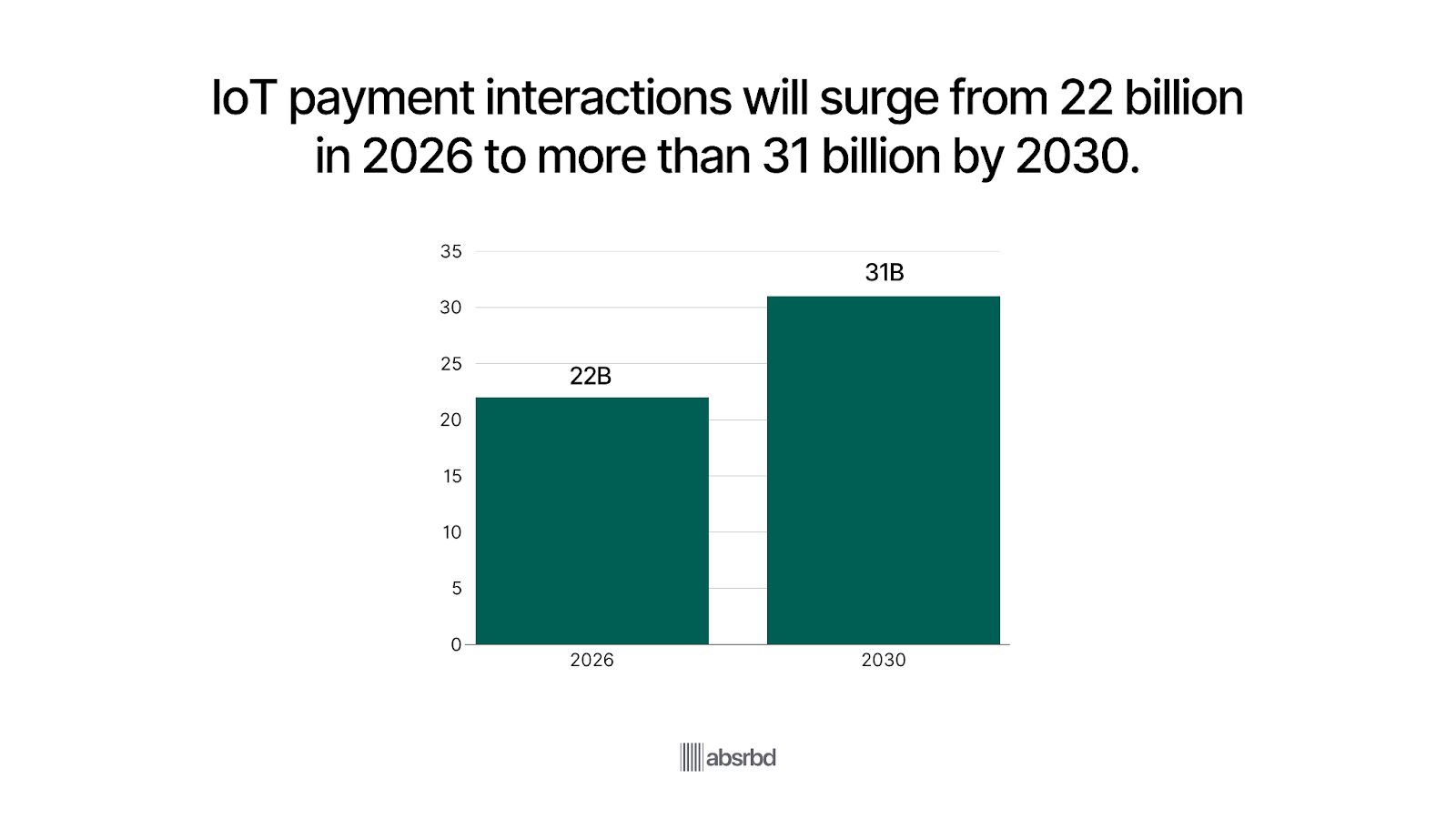

Internet of Things Devices to Handle 31.2 Billion Payment Interactions Annually by 2030

IoT-connected devices such as cars, appliances, and smart rings are integrating NFC modules to support contactless payments Statista 2025.

Global IoT payment interactions are projected to reach 31.2 billion per year by 2030, up from 22 billion in 2026. Statista

This expansion illustrates how payments are moving beyond phones into everyday connected environments.

AI Powered Fraud Detection to Reduce False Declines by 30% by 2026

Payment processors are deploying AI-based fraud detection systems capable of analyzing thousands of transactions per second. Datawalk

Machine learning models continuously adapt to detect suspicious behavior while reducing false positives. Industry analysts expect these systems to cut false declines by nearly a third within two years.

Key Challenges Facing the Contactless Payment Industry

Despite its rapid growth and global adoption, the contactless payment industry in 2026 faces several critical challenges that could hinder its scalability, security, and universal accessibility.

Regulatory Compliance and Data Privacy Pressure Intensify

Governments and regulators are tightening data security and open-banking rules in response to rising contactless adoption.

In the U.S., changing PCI DSS 4.0 standards require stronger authentication and encryption for contactless data transmission.

For payment providers, meeting global compliance obligations raises operational complexity and cost.

Security and Privacy Concerns Persist

Security remains a critical challenge for the contactless payment industry, with 40% of U.S. internet users citing digital security as a primary concern for online transactions. WIfi Talent

Consumers worry about the risks of fraud, theft, and unauthorized access to their personal and financial information.

This ongoing concern can undermine consumer trust, which is essential for the widespread acceptance of contactless payments.

Lack of Consumer Awareness and Understanding

Despite the growth in contactless payment adoption, many consumers remain unaware of how these systems work.

A significant portion of the population, particularly older generations, may prefer traditional payment methods due to unfamiliarity with contactless technology.

Research shows that approximately 60% of consumers are still hesitant to use contactless payments due to a lack of understanding of the technology and its benefits. Philadelphia Fed

This gap in knowledge can hinder adoption rates and necessitates targeted educational efforts by financial institutions and payment providers.

Integration Challenges with Existing Systems

Integrating contactless payment solutions with existing business systems can present technical difficulties.

Many merchants face compatibility issues with their current point-of-sale systems, which can disrupt the checkout process.

These integration hurdles can create friction in the customer experience, discouraging businesses from fully embracing contactless payment options.

Rising Transaction Fees Threaten Small Merchant Adoption

As more transactions shift to digital, merchants face interchange and processing fees averaging 1.5%–3.5% per transaction. Swipesum

Small businesses with tight margins are increasingly vocal about the burden of contactless payment fees.

This could slow growth in low-volume retail sectors unless regulators or networks revise fee structures.

Emerging Opportunities in the Contactless Payment Industry

As contactless payments become the global standard for in-store transactions, new technological, regulatory, and consumer trends are creating powerful opportunities for innovation and market expansion.

Biometric Payment Cards to Reach 173 Million Shipments Globally in 2026

Shipments of biometric payment cards with embedded fingerprint sensors are forecast to grow by almost 850% and reach 173 million units worldwide by 2026. NFCW

This surging growth is driven by the push for enhanced payment security and the competitive pressure from mobile wallets.

These cards have the potential to reduce fraud and give issuers new differentiators in a crowded contactless market.

Softpos Merchant Deployments to Exceed 34 Million by 2027

Global deployments of SoftPOS software-based point-of-sale solutions are expected to surpass 34.5 million merchants by 2027. Worldline

This expansion is largely propelled by micro, small and medium enterprises MSMEs seeking low-cost, flexible payment acceptance options.

As hardware POS becomes less necessary, barriers to entry for merchants decrease, enabling wider contactless adoption.

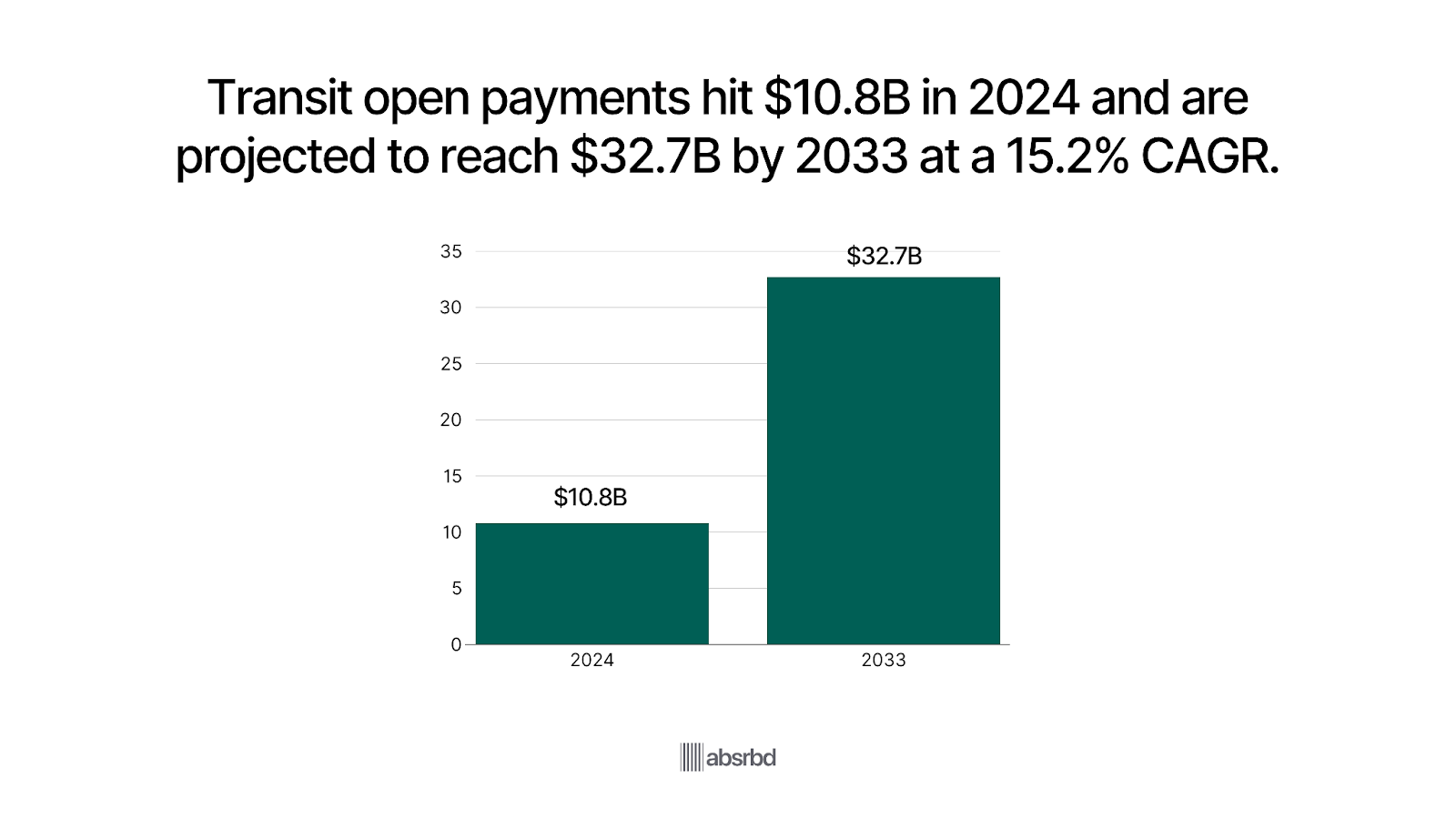

Transit Open Payments in Vehicles Market Projected to Grow From USD 10.8b in 2024 to Over USD 32.7b by 2033

The global market for transit open payments via vehicles reached about USD 10.8 billion in 2024 and is forecasted to grow at 15.2% CAGR through 2033, reaching USD 32.7 billion. Dataintelo

This reflects the rising demand for seamless, contactless fare collection in buses, trains, and ride-sharing services.

Government initiatives and commuter preference for cashless, faster boarding are accelerating this transition globally.

Expansion of Contactless Payment Acceptance in Diverse Industries

Contactless payment acceptance is expanding across various sectors, including hospitality, transportation, and healthcare.

For example, 65% of hospitality businesses plan to prioritize tap-to-pay methods in 2024, indicating a strong shift towards contactless solutions in this industry. Global Payments

This trend presents opportunities for payment providers to tailor their offerings to meet the specific needs of different sectors, facilitating smoother transactions and enhancing operational efficiency across diverse business environments.

Impact of Contactless Payment Market Behavior on Stakeholders

The widespread adoption of contactless payments is transforming the global payments industry, influencing how consumers spend, how merchants operate, and how financial institutions deliver services.

Consumers

Consumers have embraced contactless payments as their preferred way to pay, valuing the convenience, hygiene, and speed that tap-and-go transactions provide.

The shift toward digital wallets and mobile-based payments has significantly reduced reliance on cash and accelerated the move toward a more cashless society.

As security technologies such as tokenization and biometrics continue to evolve, consumer confidence in contactless payments is strengthening, making digital-first behavior the new norm.

Merchants and Small Businesses

For merchants, contactless payments have shortened checkout times and improved overall customer experience.

The ability to accept tap payments through mobile devices and simple POS systems has opened new opportunities for small and microbusinesses to participate in the digital economy.

However, managing transaction fees and keeping up with evolving technology remains a challenge, especially for smaller retailers operating on tight margins.

Financial Institutions

Banks and card issuers are benefiting from increased digital transaction volumes and deeper consumer engagement.

At the same time, they face growing pressure to enhance security measures and manage higher compliance expectations in an expanding digital payments ecosystem.

Many financial institutions are responding by investing in fraud prevention, biometric verification, and AI-powered monitoring tools to safeguard users and maintain trust.

Payment Processors and Technology Providers

Payment processors and fintech companies are at the forefront of the contactless revolution, enabling faster and more integrated payment experiences.

As competition intensifies, success increasingly depends on offering added value—such as analytics, loyalty programs, and advanced fraud protection—beyond basic transaction processing.

This shift is driving strategic partnerships and innovations across the payments technology sector.

Regulators and Policymakers

Regulators are focusing on maintaining the balance between innovation and security as contactless adoption grows worldwide.

They continue to update standards to ensure data protection, interoperability, and consumer privacy within digital payment frameworks.

Collaboration between regulators, networks, and fintechs will be essential to sustain trust and ensure equitable access to modern payment systems.

Conclusion

The contactless payment industry in 2026 reflects a market that has matured into a mainstream financial behavior rather than a niche innovation.

Adoption has accelerated across all major economies, supported by widespread POS upgrades, mobile wallet integration, and shifting consumer preferences toward speed and convenience.

This behavior marks a structural change in how people interact with money: tap-to-pay has become an expected part of everyday transactions, not a premium feature.

At the same time, the ecosystem continues to change, driven by advances in biometrics, AI-enabled fraud prevention, and the rise of wearables and IoT payment devices.

While challenges around security, interoperability, and regulation persist, the overall trajectory remains positive.

As infrastructure strengthens and digital literacy expands, contactless payments are poised to become the default global payment standard, linking consumers, merchants, and institutions through faster, safer, and more inclusive financial experiences.