In just a few years, digital banking has evolved from a convenience to a global expectation.

What began as simple online account access has expanded into a world of mobile-first apps, real-time payments, and AI-driven financial experiences used by billions.

By 2026, digital banking isn’t an alternative, it’s the default. Nearly every major financial transaction now flows through a digital channel, from savings and lending to investing and payments.

As banks race to modernize and fintechs expand their reach, user adoption, transaction volume, and revenue growth have surged at unprecedented rates.

This report compiles the latest digital banking statistics outlook for 2026, highlighting how technology, regulation, and consumer behavior are reshaping financial services worldwide.

Data Sources and Methodology

This article synthesizes data from diverse sources to provide a comprehensive overview of digital banking statistics.

Our research process includes:

Data Collection:

- Primary sources: Industry survey and government database

- Secondary sources: Academic papers, reputable industry report

- Time frame: Data collected spans from 2022 to present

Key Data Providers:

Analysis Approach:

- Cross-referencing multiple sources to ensure accuracy

- Prioritizing the most recent data available

Limitations:

- The digital banking sector data can be volatile and subject to rapid changes

- Market dynamics in digital banking can shift rapidly; readers should consider the publication date of this article.

Key Takeaway

- Digital banking market size was valued at $10.9 trillion in 2023 and is estimated to grow at a CAGR of over 3% between 2024 and 2032.

- The global digital banking market is projected to reach $19.89 trillion by 2026.

- Today, 1.75 billion registered accounts are processing $1.4 trillion a year, or about $2.7 million a minute.

- According to a report by Wifi Talents, banks that invest in digital transformation can reduce their operating costs by 20-40% while opening the door to various new revenue opportunities.

- 60% of millennials, 57% of Generation Z and 52% of Generation X primarily use mobile banking apps.

- A survey by Ping Identity showed that 81% of consumers prioritize ease of use online, with identity theft highest concern over financial loss.

- The number of traditional bank branches is declining, at a rate of 1646 branches on average per year since 2018.

Overview of Digital Banking

Digital banking has transformed the way people manage their finances, converting traditional banking into a seamless, tech-driven experience.

Since its rise in the early 2000s, it has quickly grown into a cornerstone of modern finance, offering everything from mobile transactions to AI-driven insights at customers’ fingertips.

With 78% of U.S. adults now favoring mobile apps or websites over branch visits, the shift is undeniable. Forbes Advisor

What sets digital banking apart isn’t just convenience—it’s the metamorphosis.

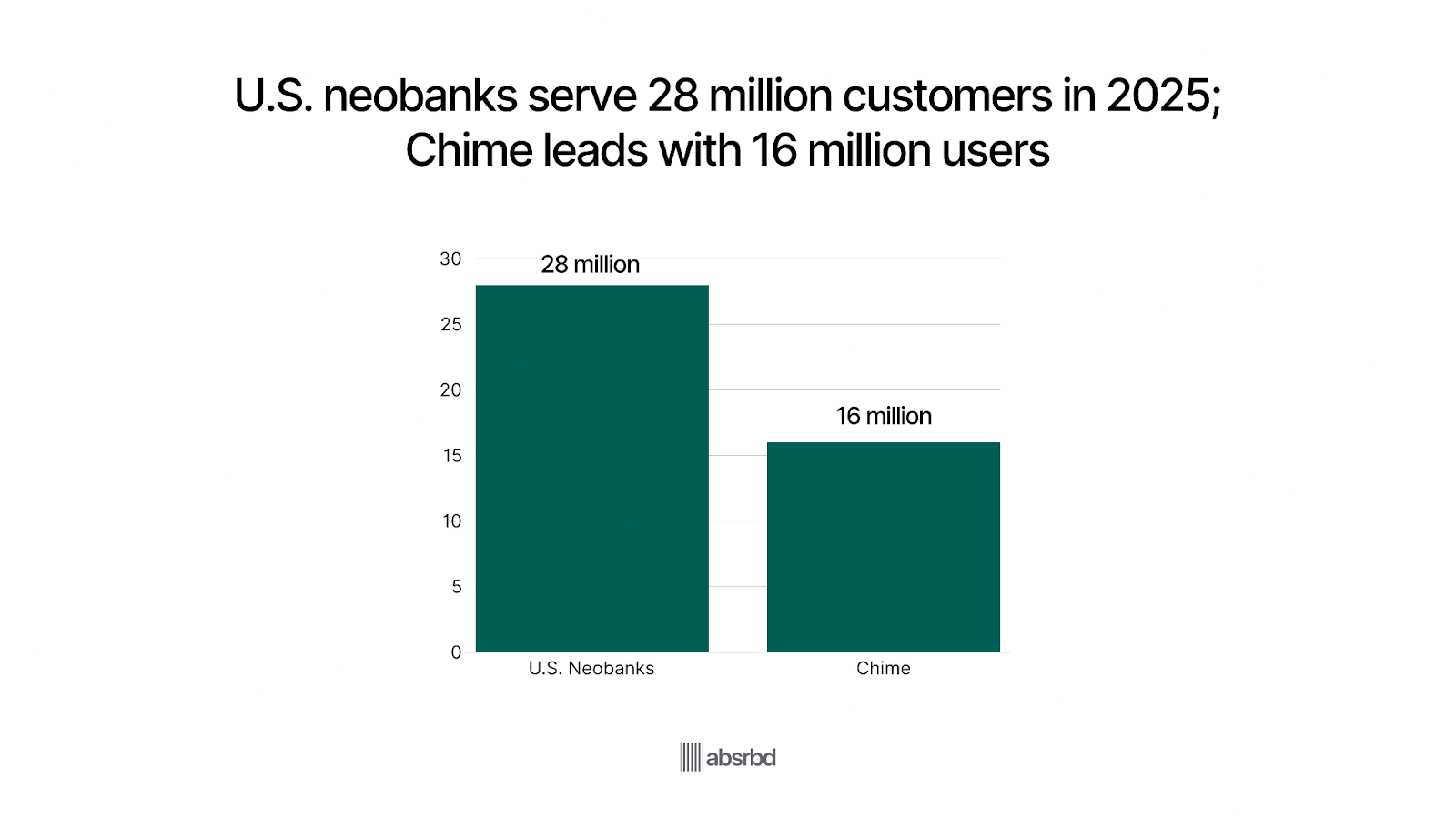

Neobanks like Chime and Revolut are challenging industry giants like JPMorgan Chase, using cutting-edge tools to cater to tech-savvy consumers. Artificial intelligence enhances customer service through virtual assistants, while blockchain promises secure, transparent transactions.

Looking ahead, the market is poised to hit $10.3 trillion by 2028, with a staggering 3.6 billion users. This growth reflects more than adoption, it signals a global movement toward accessibility and efficiency in finance.

From real-time payment tracking to personalized financial planning, digital banking redefines how we engage with money.

It’s not just a trend; it’s a shift in the financial narrative, bringing unprecedented opportunities for banks, consumers, and regulators to reshape the future of finance.

Major Digital Banking Statistics

The digital banking sector has experienced tremendous growth and innovation over the years. The following statistics highlight the current state and trajectory of digital banking:

- Digital banking market size was valued at $10.9 trillion in 2023 and is estimated to grow at a CAGR of over 3% between 2024 and 2032. Global Market Insight

- The global digital banking market is projected to reach $22.3 trillion by 2026. World metrics

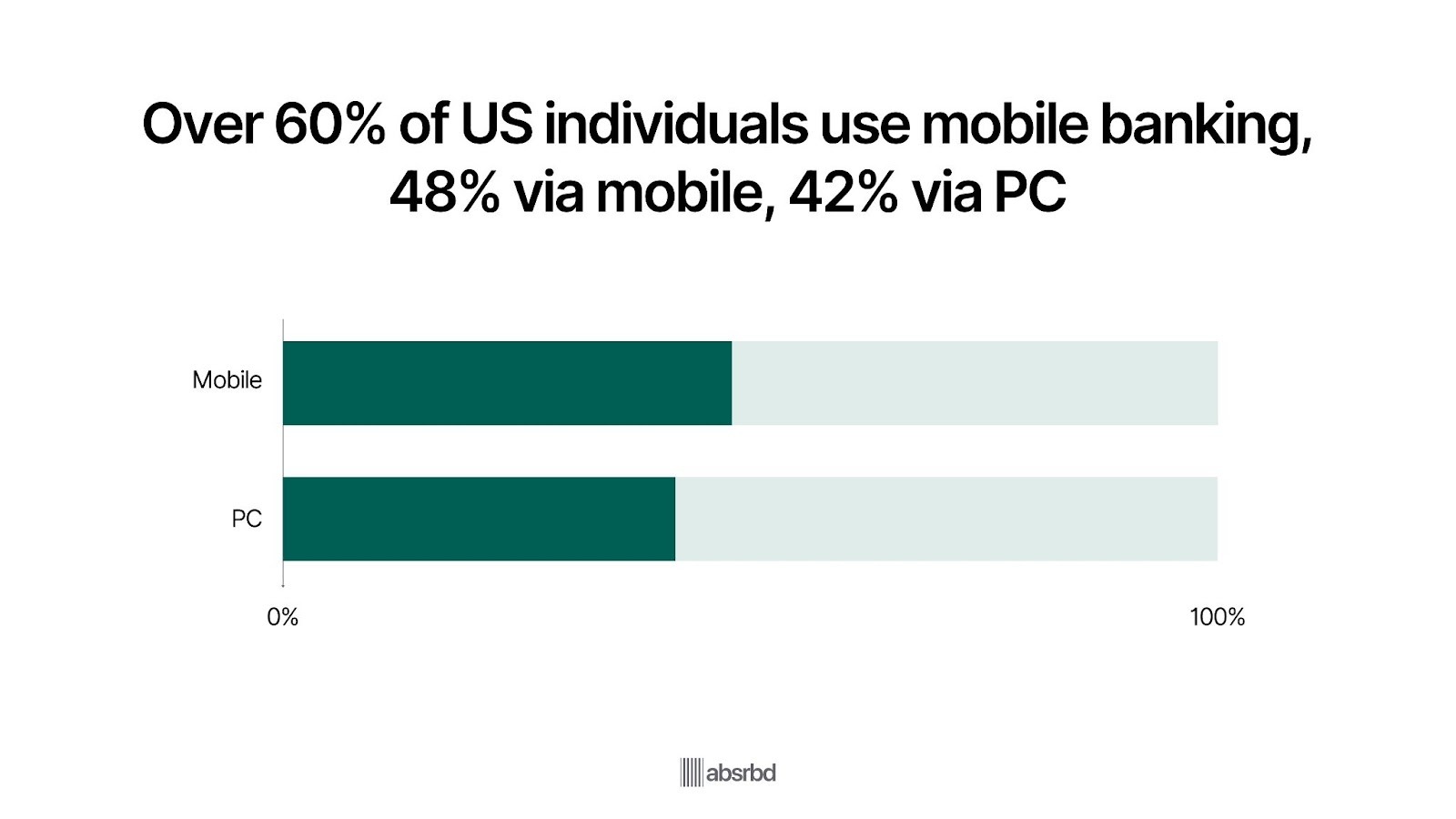

- Over 60% of Americans use online or mobile banking services, with 48% using mobile phones and 23% using PC and laptops. American Bankers Association

- Today, 1.75 billion registered accounts are processing $1.4 trillion a year, or about $2.7 million a minute. GSMA

- Global digital banking platform revenue is estimated to reach $13.4 billion by 2026. Gitnux

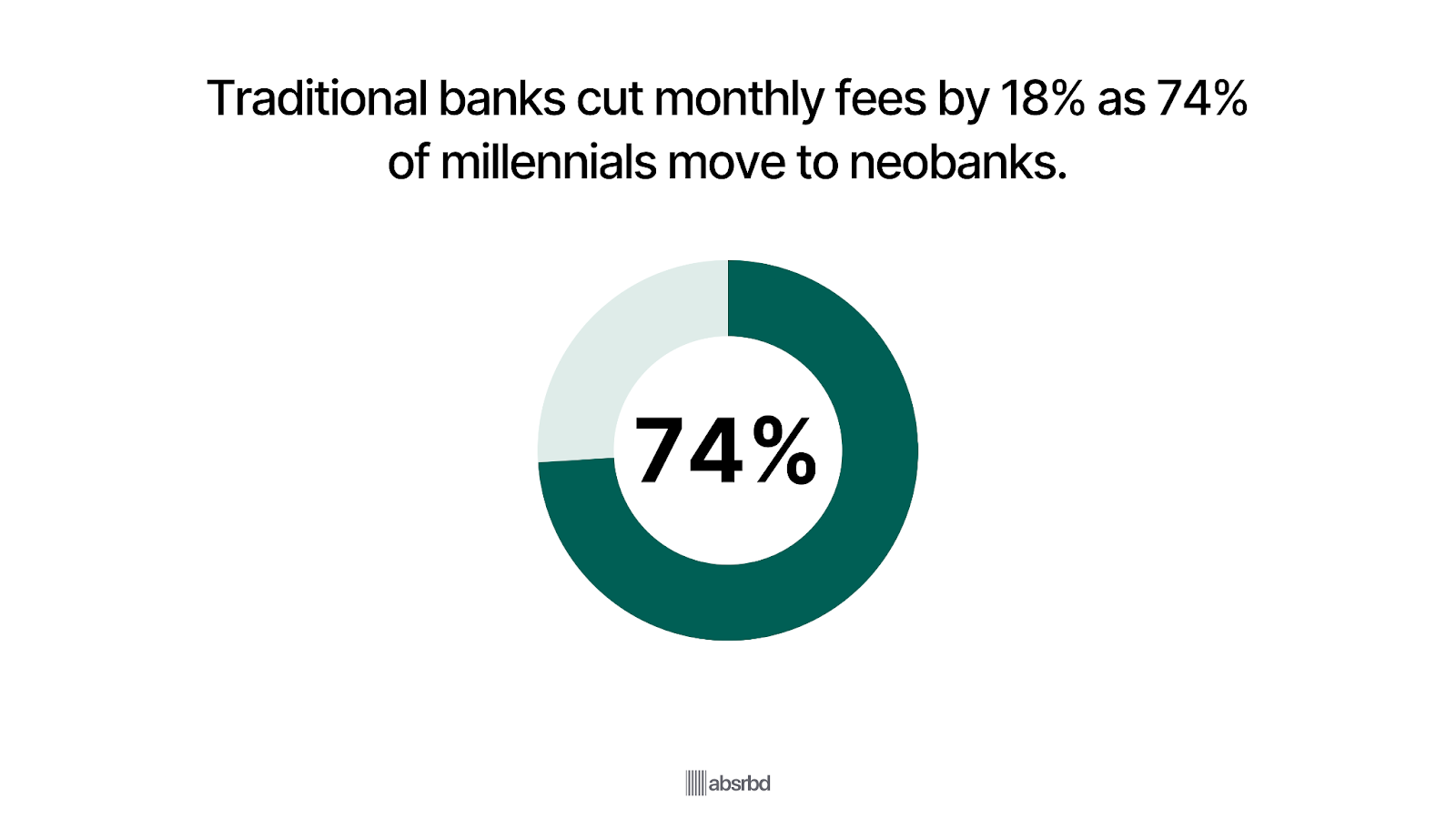

- Traditional banks cut monthly fees by 18% from 2022 as 74% of millennials switch to neobanks for lower or no fees. Coinbase

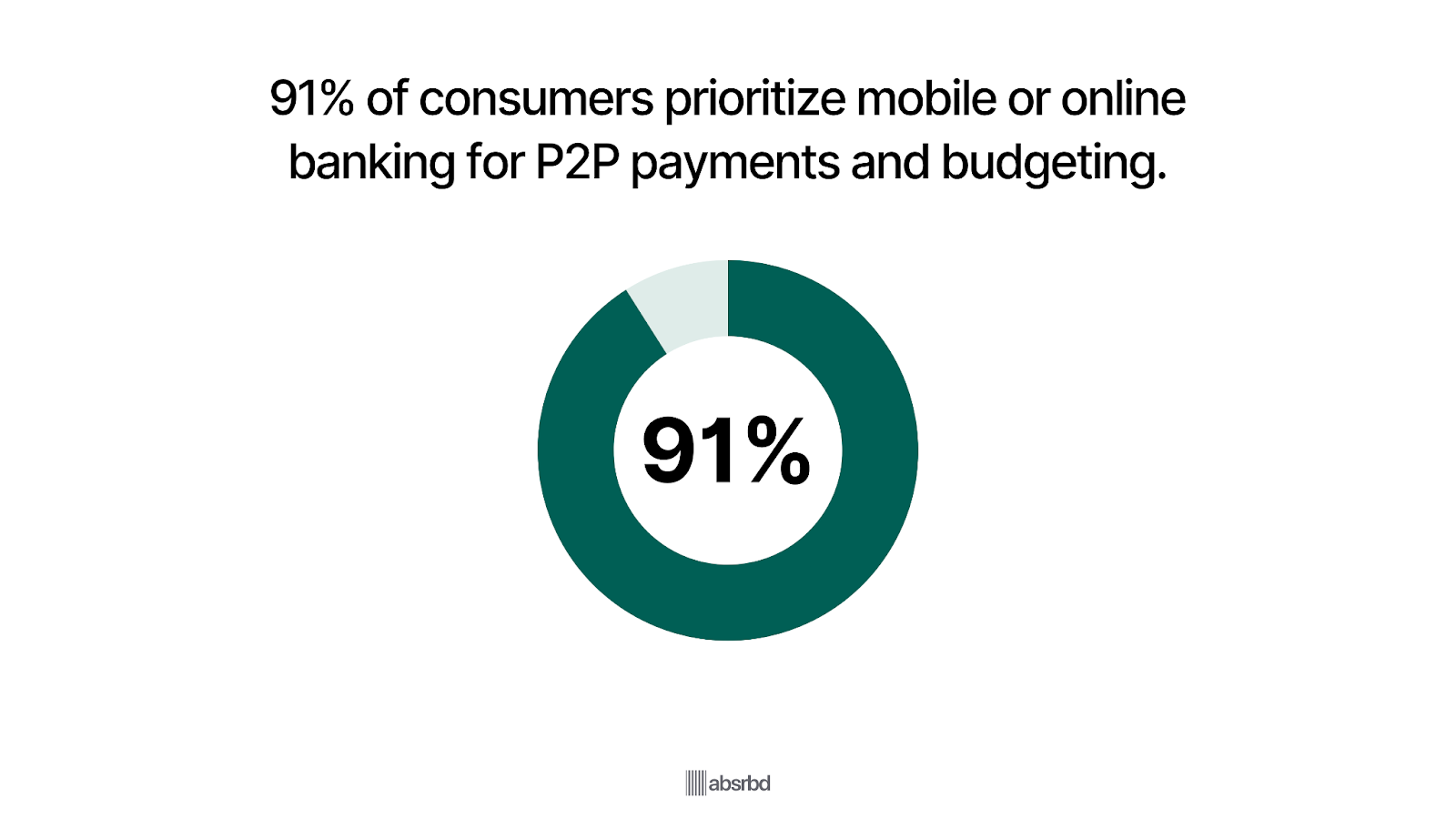

- 91% of consumers prioritize mobile/online banking access for P2P payments, budgeting, and investment services. Coinbase

- U.S. neobanks serve 28 million customers in 2025; Chime has 16 million users with 25% YoY growth. Coinbase

- 83% of digital banking users remain concerned about data breaches. Coinbase

- Biometric authentication used by 77% of mobile users; 70% of banks have multi-factor authentication. Coinbase

- AI fraud detection prevents $9.3 billion in losses annually in 2025. Coinbase

- 77% of banking interactions now occur digitally; the UK has 87% adult online banking usage. Coinbase

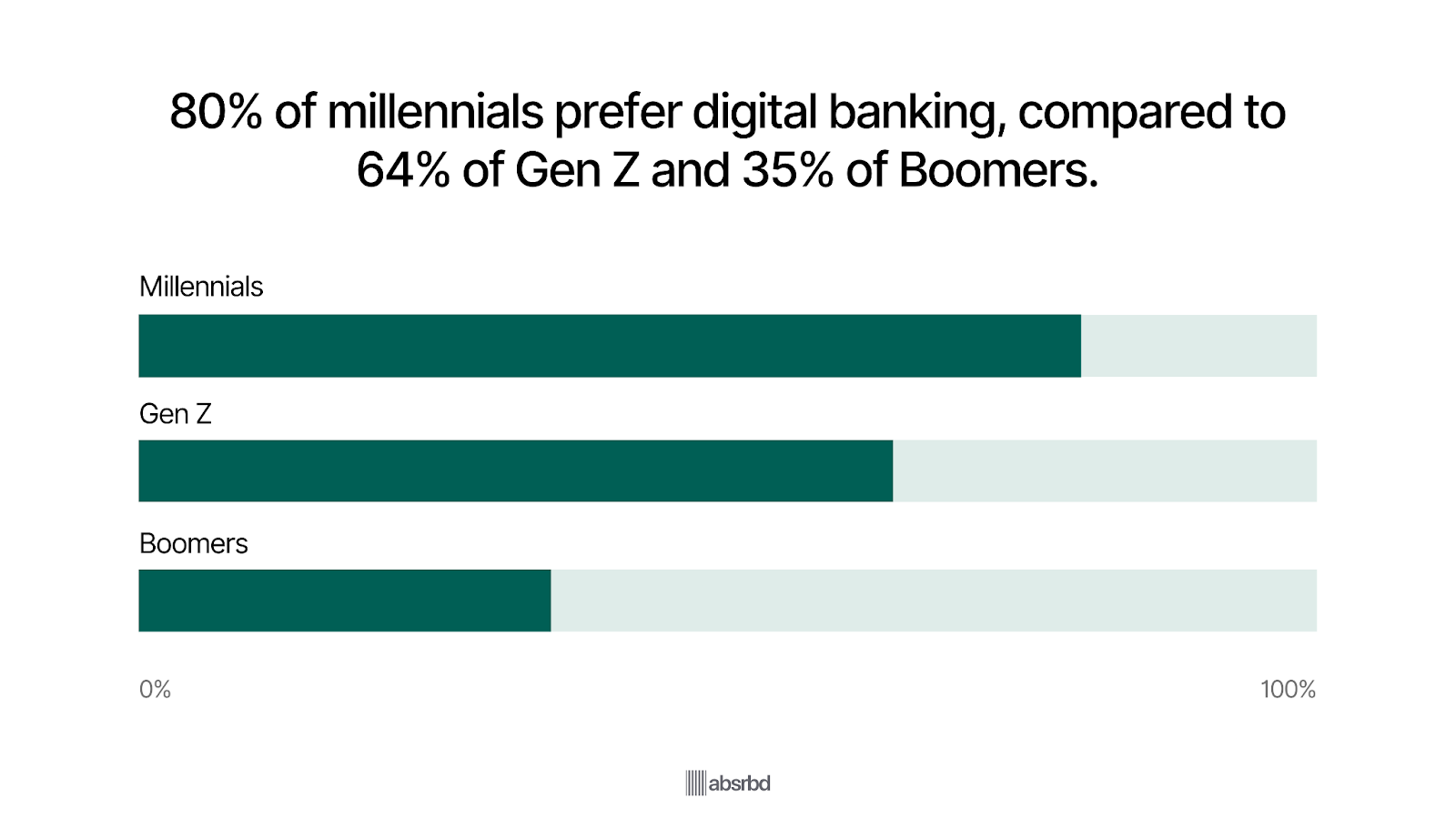

- 80% of millennials prefer digital banking, versus 64% of Gen Z and 35% of Boomers, cementing mobile as the go-to channel. Coinbase

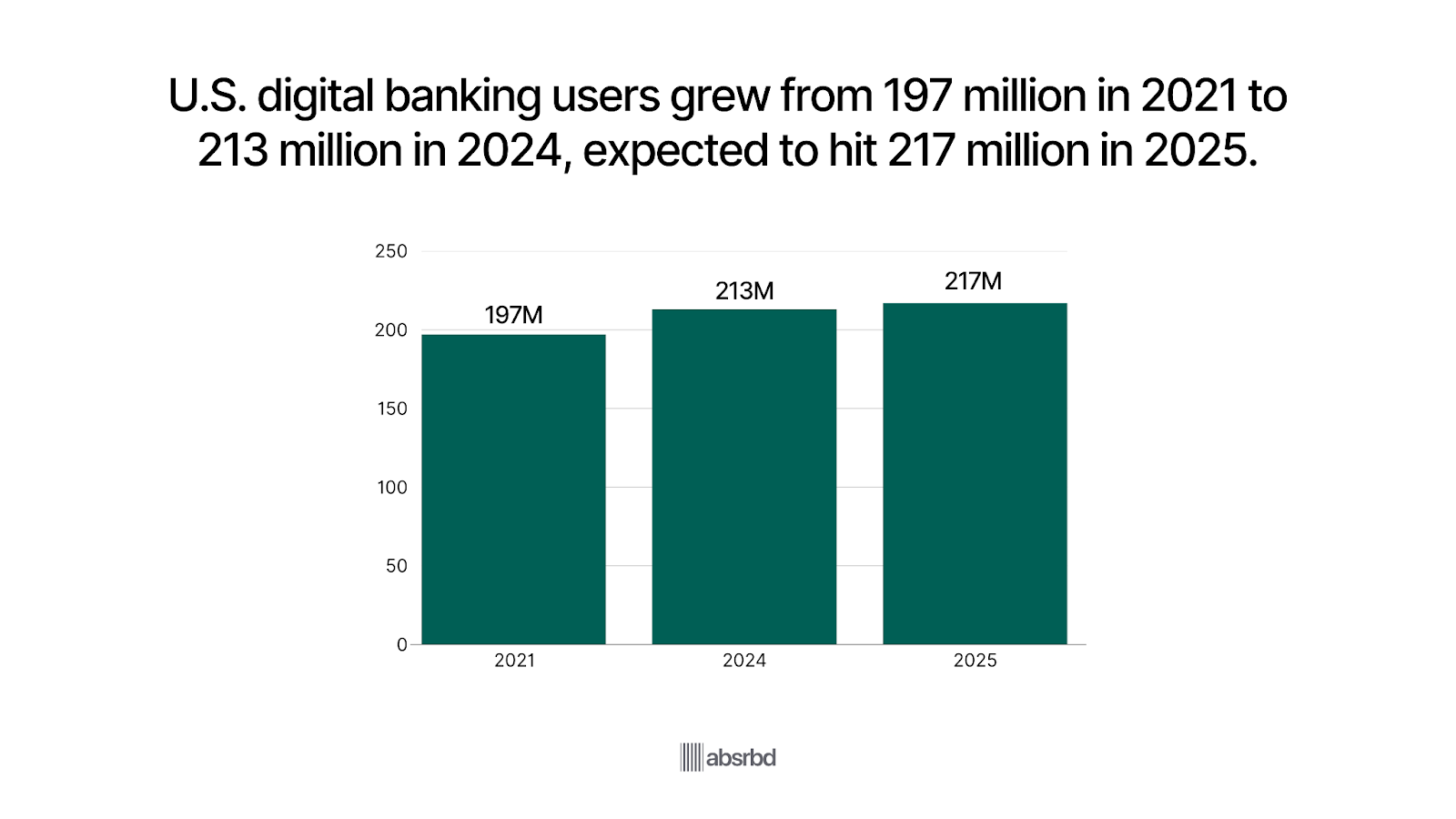

- U.S. digital banking users grew from 197M in 2021 to 213M in 2024, expected to reach 217M by 2025. Coinbase

- 76% of global consumers use some form of digital banking application. Wifitalents

- In Western Europe, the online banking penetration rate is around 70%. Scoop

- China has a high online banking penetration rate, with over 80% of Chinese internet users engaging in online banking activities. Scoop

Major Trends

The digital banking sector is changing rapidly, with several key trends shaping its future. Here are the major developments based on recent data and industry analysis:

Over 76% of American Customers Use Mobile Banking Apps

Mobile banking continues to gain traction as consumers increasingly prefer the convenience of managing their finances on the go.

The number of traditional bank branches is declining, with over 1,500 closures reported in the US CTMFile and 454 branches at risk of closure in Australia in 2023. ABCNews

In contrast, digital banks are thriving, as evidenced by the increasing preference for mobile banking, which rose from 15.1% in 2017 to 48% in 2023. Bankrate

The Ipsos-Forbes U.S. Weekly Consumer Confidence Survey found that just over three-fourths of Americans 76% use their financial institution’s mobile app for everyday banking needs. The Financial Brand.

This highlights a fundamental shift in consumer behavior towards digital-only banking solutions, prompting traditional banks to innovate or risk obsolescence.

Experience-Oriented Banking

Customer experience has become a key differentiator in the financial services sector, with 80% of European banks prioritizing digital banking as a strategic focus and 61% of consumers believing that digital-only banks provide better customer service. WifiTalents

Banks are investing in technologies that enhance user experience, such as personalized services and advanced analytics.

This is important as it helps banks retain customers and attract new ones, with studies indicating that 63% of consumers expect all financial transactions to be digital in the future. WifiTalents

Contactless Payment Adoption Surge By 80%

The COVID-19 pandemic has accelerated the adoption of contactless payments, with many consumers now preferring this method for its convenience.

Contactless payment appears to have transcended the and taken over the payments space.

A 2021 report noted that over 80% of retailers used contactless payment methods in the previous 12 months. Stripe

In addition to widespread retailer adoption, digital wallets are on track to become the most popular online payment method as of 2024.

And with 15% of consumers reporting that they regularly leave their physical wallets at home, in-person businesses should prepare themselves to accept contactless payments. Stripe

This development reflects changing consumer preferences and the need for banks to innovate their payment solutions to meet demand.

Generative AI Transforming Banking Services

The integration of generative AI in banking is transforming customer interactions and operational efficiency.

By 2030, the global algorithmic trading market, which is closely linked to AI advancements, is expected to grow from $13.02 billion to $31.30 billion, reflecting a 13.6% annual growth rate. Spherical Insights

This is important because it allows banks to offer personalized services through AI-powered chatbots and advanced fraud detection methods.

For example, JPMorgan Chase has implemented AI to automate the interpretation of loan agreements, drastically reducing processing time and enhancing service quality.

Expansion of Open Banking as 85% of Banks Implementing Open APIs

Open banking is gaining momentum as financial institutions adopt open APIs Application Programming Interfaces to facilitate greater data sharing and integration.

APIs allow banks to programmatically share functionality with third-party FinTechs, a process known as Banking-as-a-Service BaaS.

And BaaS is predicted to boom in the coming years.

According to a Finastra survey, BaaS represents a $7 trillion industry, and 85% of senior executives are already implementing BaaS solutions or plan to do so in the next 12-18 months.

APIs can help digital-first banks retain a competitive advantage and allow new services to be built upon their core infrastructure. Treblle

The integration of financial data aggregation is crucial because it fosters competition and enhances customer choice, as seen with services like Plaid, which aggregates financial data across various accounts to provide users with a comprehensive view of their finances.

Growing Integration of Blockchain in Banking

Blockchain is transforming digital banking through KYC and due diligence. It enhances security, streamlines transactions, and could save banks up to $12B annually. Reuters

Over 105 countries are exploring CBDCs to boost transparency and reduce fraud. IMF

Financial institutions are likely to migrate their Authentication and Customer Due Diligence operations to decentralized blockchain platforms in 2024 as digital identities become more widely adopted. Elitex

Customers' data will be stored on distributed ledgers, allowing for more effective identity verification, lower data storage costs, and greater data protection mechanisms.

Enhanced Digital Identity Verification With 60% Increase in Use of Biometric Authentication

Digital identity verification is becoming more sophisticated, with biometric methods such as fingerprint, voice recognition, iris scan and facial recognition seeing rapid adoption.

As of 2023, a survey found that nearly 46% of companies in the US have replaced or planned to replace passwords with biometrics. Techmagic

50% of the businesses in the retail and financial services industries in the US plan to implement passwordless authentication in the next one to three years. Techmagic

And nearly 60% of respondents among IT and cybersecurity executives intend to replace workplace passwords with biometrics. Techmagic

This shift is crucial for enhancing both security and user convenience. For instance, leading banks like HSBC and Wells Fargo are employing biometric technologies to streamline their customer verification processes and bolster security measures.

Biometric ATM Market Size was valued at USD 35.2 Billion in 2022.

The Biometric ATM Market industry is projected to grow from USD 36.3 Billion in 2023 to USD 46.7 Billion by 2032, exhibiting a compound annual growth rate CAGR of 3.20% during the forecast period 2023 - 2032. Market Research Future

Key Challenges Facing the Digital Banking Sector

The digital banking sector is currently navigating several key challenges that impact its growth and efficiency.

Here are the major challenges, supported by statistics and relatable examples:

Cybersecurity Threats

Cybersecurity remains one of the most pressing challenges for digital banking.

With the increasing reliance on digital platforms, banks have become prime targets for cybercriminals.

Cybersecurity is the number one risk for the global banking industry, with banks needing to invest heavily in robust security measures.

For instance, in 2021, the financial sector experienced a 233% increase in ransomware attacks, highlighting the urgent need for enhanced cybersecurity protocols. UK Parliament

Customer Trust and Fraud Prevention

Building and maintaining customer trust is crucial for the success of digital banking. Instances of data breaches can severely undermine customer confidence.

A survey by Ping Identity showed that 65% of Australians are concerned about identity theft when using digital banking services. CFOTech

Research by YouGov shows that half of consumers feel there is too much risk from hackers when using digital financial services and worry about their identity being stolen 50%.

For example, the Capital One data breach in 2019 affected over 100 million customers, leading to fatal reputational damage and regulatory scrutiny. ACM Digital Library

Regulatory Compliance Burden

The financial industry is heavily regulated, and digital banking introduces additional compliance challenges.

Banks must navigate a complex web of regulations, including anti-money laundering AML laws, cyber security standards and Know Your Customer KYC requirements.

According to a report from Profile Software, 50% of banks are still in the early stages of digital transformation, struggling to meet these regulatory demands effectively. NEXGEN

Technological Integration and Legacy Systems

Many traditional banks face difficulties integrating new digital technologies with existing legacy systems. This challenge can lead to inefficiencies and increased operational costs.

Over 70% of the industry executives surveyed indicate that embedded finance is either core or complementary to their business strategies.

Yet only 20% said they currently offer embedded finance solutions, indicating difficulties in achieving interoperability between old and new systems, which can hinder their ability to offer seamless digital services. IBM

Digital Inclusion

While digital banking offers numerous benefits, it also exacerbates issues of digital exclusion.

Not all customers have access to reliable internet or digital devices, particularly in underserved areas.

A report by the World Bank highlighted that approximately 1.7 billion adults worldwide remain unbanked, emphasizing the need for banks to address digital inclusion to ensure equitable access to financial services.

According to the Global Findex Database, account ownership in Sub-Saharan Africa SSA stood at 55% in 2021, against the global average of 76% World Bank.

Competition from Fintech and Big Tech

Digital banks face increasing competition from fintech startups and big tech companies entering the financial services space.

Global investment in fintech sank to a five-year low of $113.7 billion across 4,547 deals in 2023, of which the US took $73.5 billion across 1,734 deals, intensifying competition. KPMG

Apple's expansion into financial services, with products like the Apple Card and Apple Pay Later, exemplifies how tech giants are challenging traditional banking.

This current is forcing digital banks to innovate quickly, enhance user experiences, and differentiate their offerings to retain market share in an increasingly crowded and tech-driven financial landscape.

Emerging Opportunities in Digital Banking

The digital banking sector is currently experiencing a range of emerging opportunities that capitalize on technological advancements and changing consumer preferences.

Here are some key opportunities supported by statistics and relatable examples:

Personalized Banking Services

The demand for personalized banking experiences is on the rise, with 80% of consumers expressing a preference for tailored financial services. Epsilon

Digital banks can leverage data analytics and artificial intelligence to create customized products that meet individual customer needs.

For example, banks like Monzo and Revolut offer personalized budgeting tools and spending insights, enhancing customer engagement and satisfaction.

Embedded Finance

The integration of financial services into non-financial platforms, known as embedded finance, is gaining traction.

This allows companies to offer financial products directly within their existing services.

For instance, ride-sharing apps like Uber are beginning to provide payment solutions, enabling users to pay for rides without leaving the app.

This opens up new revenue streams for both the apps and financial service providers.

Seamless Digital Payments

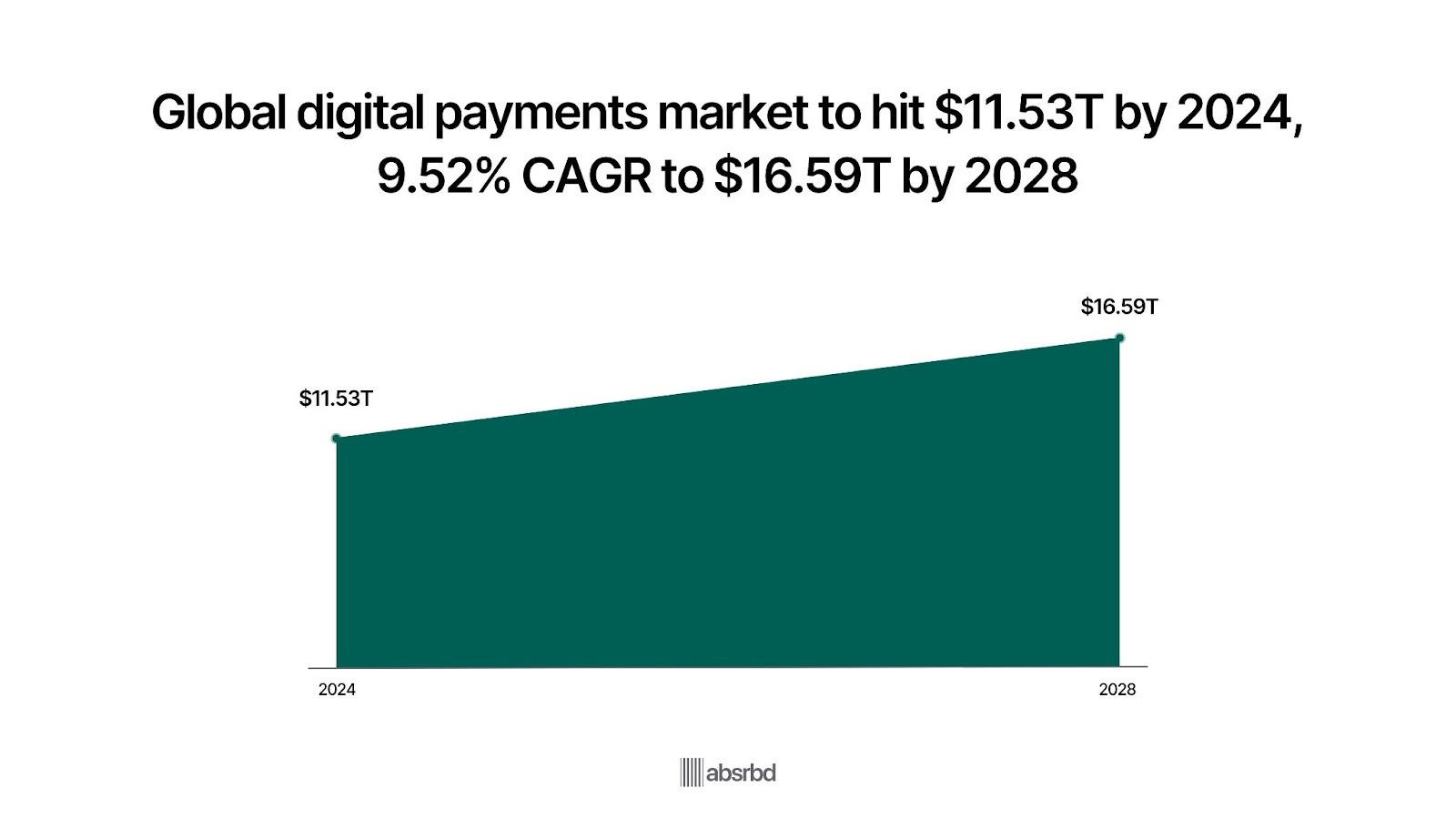

The rise of e-commerce has created opportunities for digital banking to innovate in payment solutions.

The global digital payments market is projected to reach $11.53 trillion by 2024, growing at a CAGR 2024-2028 of 9.52%, resulting in a projected total amount of $16.59 trillion by 2028. Statista

Digital banks can capture this growth by offering secure and user-friendly payment options, such as contactless payments and mobile wallets, to meet the increasing consumer demand for convenience.

Enhanced Cybersecurity Solutions

As cyber threats continue to rise, with ransomware attacks in the financial sector increasing from 55% to 64% in 2023, there is a growing demand for robust cybersecurity measures. Sophos News

Digital banks have the opportunity to differentiate themselves by investing in advanced security technologies, such as biometric authentication and AI-driven fraud detection systems.

For example, banks like HSBC are implementing AI solutions to monitor transactions in real time, enhancing security and customer trust. HSBC

Financial Inclusion Initiatives

The digital banking sector has a unique opportunity to promote financial inclusion by reaching underserved populations.

Approximately 1.7 billion adults globally remain unbanked, representing a vast market for digital banking solutions. World Bank

Companies like Chime and N26 are focusing on providing accessible banking services through mobile apps, helping to empower individuals without traditional banking access.

These opportunities highlight the potential for innovation and growth within the digital banking sector.

By embracing these shifts, financial institutions can enhance customer experiences, improve operational efficiency, and drive revenue growth in an increasingly competitive market.

Impact of Digital Banking on Stakeholders

The impact of digital banking on stakeholders is profound, influencing various aspects of the financial ecosystem, including customers, banks, regulators, and investors.

Here are key points illustrating this impact, supported by statistics and relatable examples:

Impact on Consumers

Digital banking has transformed customer expectations, with 80% of consumers expressing a preference for personalized banking experiences. Yahoo Finance

Banks that utilize data analytics and AI to tailor services can invariably improve customer satisfaction and loyalty.

For example, Capital One's mobile app offers personalized financial management tools, leading to increased customer engagement and retention rates.

Great strides have been made toward financial inclusion, the number of adults without access to an account has steadily declined from 2.5 billion in 2011 to 1.7 billion in 2017 to 1.4 billion in 2021. As of 2021, 76% of the world’s adult population had an account. World Bank

For example, mobile banking apps like M-Pesa in Kenya have successfully brought millions of people into the financial system, allowing them to perform transactions and access credit without traditional banking infrastructure.

Impact on Traditional Banks

Pressure to digitize operations and compete with fintech companies.

As of 2023, 46% of traditional banks reported partnering with fintech companies to enhance their digital offerings.

JPMorgan Chase invested $12 billion in technology in 2022, primarily to improve its digital banking capabilities.

Impact on Fintech Companies

Rapid growth and increased market share in financial services.

Global fintech funding reached $75.2 billion in 2023.

Revolut, a digital-only bank, reached 25 million customers worldwide by 2023.

Impact on Regulators

Need to adapt regulations to address new technologies and business models and enhance consumer protection.

By 2023, over 60 countries had implemented or were in the process of implementing open banking regulations.

The European Union's revised Payment Services Directive PSD2 mandated banks to share customer data with third-party providers through secure APIs.

Impact on Cybersecurity Firms

Increased demand for advanced security solutions in the financial sector.

Global spending on cybersecurity in the banking sector was projected to reach $70 billion by 2024.

Many banks have implemented biometric authentication methods, with fingerprint and facial recognition becoming common features in banking apps.

Impact on Unbanked and Underbanked Populations:

Digital financial services helped bring an estimated 1.2 billion previously unbanked individuals into the formal financial system globally by 2023.

M-Pesa, a mobile money transfer service in Kenya, has played a major role in financial inclusion, serving over 50 million users across Africa by 2023.

Impact on Bank Employees

A 2023 survey found that 67% of financial institutions cited difficulty in hiring qualified tech talent as a major obstacle to their digital transformation efforts.

Many banks have been retraining their staff to handle more complex queries and provide personalized financial advice as routine transactions are increasingly handled digitally.

Impact on Small and Medium Enterprises SMEs

By 2023, 70% of SMEs reported using digital banking services for their business operations.

Online lending platforms like Kabbage have provided quick access to capital for many small businesses, often with faster approval processes than traditional banks.

Investment Opportunities for Stakeholders

The growth of digital banking presents new investment opportunities for stakeholders. The global digital banking market is projected to reach $22.3 trillion by 2026 World Metrics, growing at a compound annual growth rate CAGR of 8.5%.

This growth attracts investors looking to capitalize on innovative fintech solutions and digital banking platforms.

Companies like Chime and Revolut have received huge venture capital funding, reflecting investor confidence in the future of digital banking.

Conclusion

The digital banking sector faces both challenges and opportunities. While regulatory complexity and cybersecurity threats pose serious hurdles, the potential for enhanced customer experiences and financial inclusion remains crucial.

The rapid adoption of open banking APIs illustrates this duality, offering new avenues for innovation while raising data privacy concerns.

Industry players navigating this market must balance technological advancement with robust security measures and regulatory compliance.

Those who successfully integrate emerging technologies like AI and blockchain while maintaining customer trust are likely to gain a competitive edge and market share.

As we look to the future, the ability to adapt quickly to changing consumer demands and regulatory requirements will separate the leaders from the followers in the evolving world of digital banking.

Frequently Asked Questions

How much of Banking is Digital?

The penetration rate of online banking in the U.S. has seen substantial growth from 2019 to 2023. According to Statista, over 66% of the population utilized online banking services in 2023.

This drift is expected to continue, with projections indicating that the penetration rate will surpass 79% by 2029. Statista

Furthermore, as of 2022, approximately 73% of adults actively used online banking, reflecting a major shift in consumer behavior towards digital financial services.

Is digital banking the future?

The digital transformation in banking is not just a bias; it's indeed a metamorphosis that is shaping how we manage our money, conduct our business and plan our futures. Digital banks are the architects of a more accessible, personalized and efficient financial world.