Did you know that electronic Know Your Customer (eKYC) processes can reduce customer onboarding times by up to 90%? (McKinsey)

This transformational shift is restructuring the entire financial services industry.

This article explores key eKYC statistics and drifts, examining the rapid adoption rates across global markets, the impressive reduction in fraud cases, and the substantial cost savings driving this financial phenomenon.

We'll dive into how eKYC is transforming customer experiences, enhancing regulatory Compliance, and accelerating digital transformation in banking and beyond.

Join us as we unpack the data behind this technological leap in identity verification and its profound impact on the future of finance.

Data Sources and Methodology

This article combines open-access resources and proprietary data to present accurate, up-to-date statistics and relevant developments in the Money Service Business.

Our methodology involves:

- Aggregating data from government databases, industry reports, and academic publications

- Incorporating exclusive insights from leading industry providers

- Regular updates to reflect the latest information

Key data providers include:

- Bureau of Justice Statistics

- CNBC

- Internet Crime Complaint Center

- Statista

- Facts & Factors

- Markets and Markets

While we strive for accuracy, occurrences in the eKYC market are shifting rapidly.

These statistics reflect current patterns and should not be considered permanent facts.

Key Takeaways

- The global e-KYC market size was worth around $1.57 billion in 2021.

- A research by imarc group projected the market to reach $3.39 billion by 2032.

- The global facial recognition market is expected to grow from $6.3 billion in 2023 to $13.4 billion by 2028 at a CAGR of 16.3%.

- In 2021, Identity fraud cost Americans about $56 billion, with about 49 million consumers falling victim.

- Almost 60% of victims were reported to be over 60 years of age.

- The performance of e-KYC solutions is assessed by metrics like False Acceptance Rate (FAR) and False Rejection Rate (FRR), with industry standards targeting an average of no more than 5% for each.

- The average cost of a data breach in the financial sector reached $54.88 million.

- 63% of European consumers abandoned digital banking applications in 2020 due to lengthy onboarding processes.

Overview of Electronic KYC

Electronic Know Your Customer (eKYC) burst onto the scene in the early 2000s, propelled by the digital transformation in finance and stricter regulatory requirements.

At its core, eKYC is the digital process of verifying a customer's identity remotely, eliminating the need for physical presence or paperwork.

Since its debut, eKYC has transformed dramatically.

The introduction of biometric verification in 2010 and AI-powered document analysis in 2015 marked pivotal moments in its development.

Today, the eKYC sector is a high-tech tapestry, weaving together facial recognition, machine learning, and blockchain technologies.

Industry giants like Onfido, Jumio, and Trulioo dominate the field, while regulatory frameworks such as GDPR and ever-evolving cybersecurity challenges continue to mold its development.

With the global eKYC market valued at $1.57 billion in 2021 and projected to grow at a staggering 21.55% annually through 2030, it's become a linchpin in the fight against financial crime and in enhancing customer onboarding experiences. (Facts and Factors)

This positions eKYC as a critical focus for financial institutions, fintech innovators, and regulators.

As our world becomes increasingly digital, eKYC isn't just optimizing processes – it's redefining how we establish trust online.

Its influence extends beyond banking, reaching into healthcare and beyond, heralding a future where identity verification is frictionless, secure, and omnipresent.

Key Statistics

- The global e-KYC market size was worth around $1.57 billion in 2021. (Facts and Factors)

- The market is projected to grow to around $2.79 billion by 2030, with a compound annual growth rate (CAGR) of roughly 21.55% between 2023 and 2030. (Facts and Factors)

- Another research by Imarc Group projected the market to reach $3.39 billion by 2032. (Caption:

- Last year, close to 63 billion eKYCs were done globally and the cost of acquiring a customer fell by 99% in many places. (Hindustan Times)

- The number of digital identity verification checks will surpass 70 billion in 2024. (Juniper Research)

- In 2021, Identity fraud cost Americans about $56 billion, with about 49 million consumers falling victim.

- Most victims, almost 60%, report being over 60 years of age. (IC3)

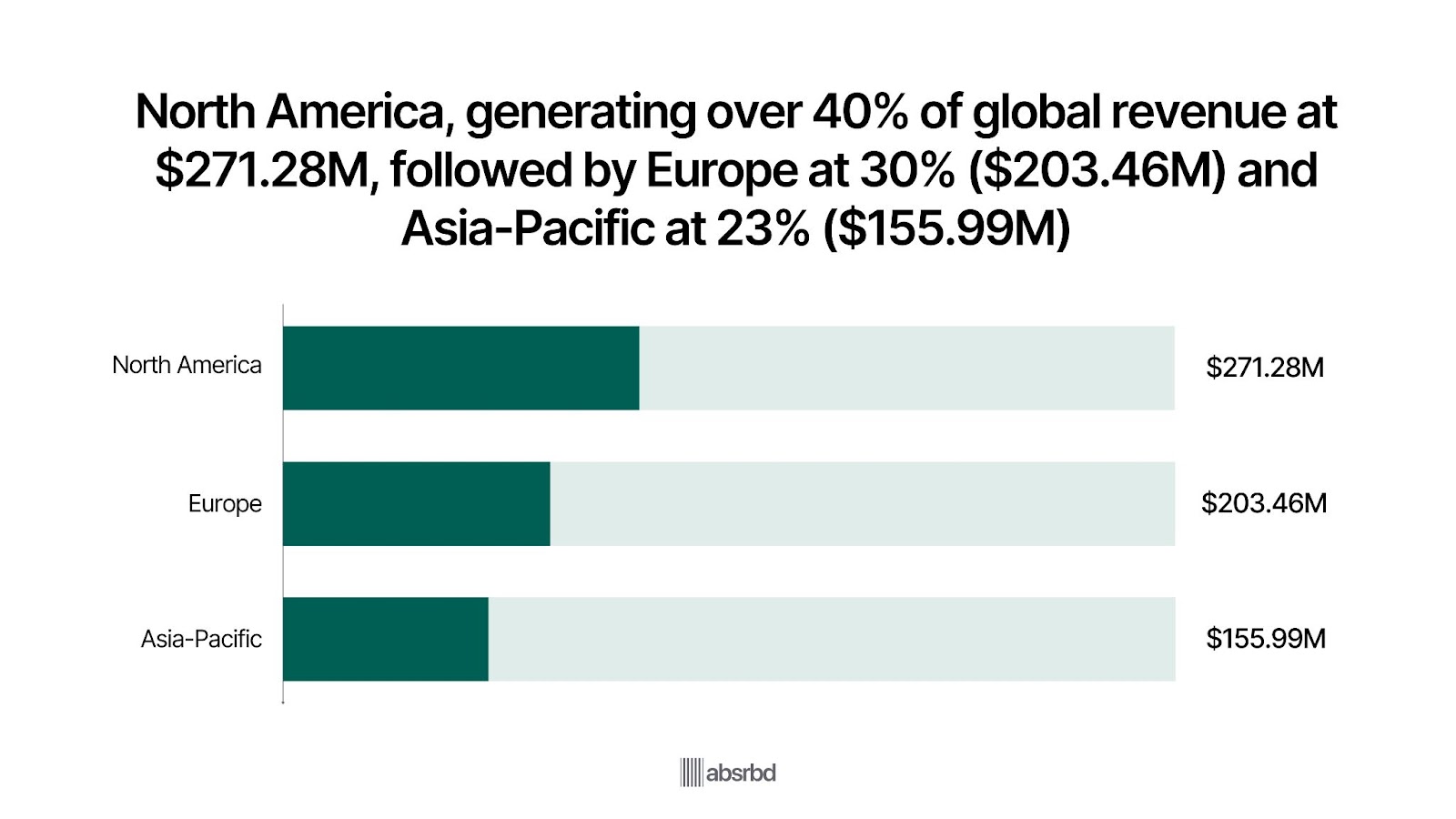

- North America, with over 40% of global revenue ($271.28 million), will grow at a 20.2% CAGR from 2024 to 2031, followed by Europe (30%, $203.46 million) and Asia-Pacific (23%, $155.99 million, 24.0% CAGR). (Cognitive Market Research)

- The performance of e-KYC solutions is assessed by metrics like False Acceptance Rate (FAR) and False Rejection Rate (FRR), with industry standards targeting an average of no more than 5% for each. (Jumio)

Major Trends Driving eKYC Market

The electronic Know Your Customer (eKYC) market has experienced significant growth as financial institutions and businesses increasingly prioritize streamlined and secure customer verification processes.

eKYC is the digital evolution of traditional KYC, leveraging technology to improve the accuracy, speed, and efficiency of onboarding customers.

Here are some major trends driving the growth and innovation in the eKYC market:

Rapid Market Growth

The e-KYC market is projected to grow from USD 518.38 million in 2022 to USD 2,445.65 million by 2030, reflecting a compound annual growth rate (CAGR) of 21.40%. (Vantage Market Research)

This rapid expansion is notable as it highlights the increasing reliance on digital identity verification processes across various sectors, particularly in banking and finance.

The shift towards e-KYC solutions is driven by the need for enhanced security measures against identity theft and fraud, which cost Americans over USD 56 billion in 2020 alone, emphasizing the urgent demand for secure digital solutions. (Javelin Strategy and Research)

Rising Identity Fraud Incidents

The increasing frequency of identity-related fraud is a major driver for the e-KYC market. In 2021, identity fraud caused a total of $16.4 billion in damages in the U.S., affecting nearly 49 million individuals. (Bureau of Justice Statistics)

This drift underscores the importance of implementing robust eKYC systems to mitigate risks associated with identity theft.

Financial institutions are adopting e-KYC solutions not only to comply with regulatory requirements but also to protect their customers and enhance trust in digital transactions, making it a critical component of modern financial operations.

Increasing Regulatory Compliance Requirements

The growing complexity and stringency of global financial regulations are remarkably driving the eKYC market.

For instance, the implementation of the Fifth Anti-Money Laundering Directive (5AMLD) in the European Union in 2020 expanded the scope of KYC requirements to include crypto-asset service providers. (Bloomberg Law)

Similarly, the USA PATRIOT Act mandates financial institutions to verify customer identities and maintain records. (U. S. Department of Treasury)

These regulations have led to a surge in eKYC adoption, with the global market size projected to reach $2.79 billion by 2030, growing at a CAGR of 21.55% from 2023 to 2026. (Facts and Factors)

Banks like HSBC have implemented advanced eKYC systems to comply with these regulations, reducing onboarding time from days to minutes. (Innovatrics)

Digital Transformation in Financial Services

The rapid digitalization of financial services is a key driver for eKYC market growth.

As traditional banks and fintech companies increasingly offer online and mobile banking services, the need for secure and efficient digital customer onboarding has become paramount.

For example, the COVID-19 pandemic accelerated this drive, with 71% of global consumers using digital banking channels weekly in 2020, up from 58% the previous year. (RFI Global)

This shift has led to increased investment in eKYC solutions.

DBS Bank in Singapore reported a 216% year-on-year increase in digital account openings in 2020, facilitated by their advanced eKYC system. (DBS Bank)

The mobile biometrics market, a crucial component of many eKYC solutions, is expected to reach $184.8 billion by 2031, growing at a CAGR of 22.5%. (Allied Market Research)

Advancements in Biometric Technologies

The emergengence of biometric technologies has tremendously enhanced the capabilities and accuracy of eKYC solutions.

Latest discoveries in facial recognition, fingerprint scanning, and voice recognition have made identity verification more secure and user-friendly.

For example, the global facial recognition market is expected to grow from $6.3 billion in 2023 to $13.4 billion by 2028 at a CAGR of 16.3%. (Markets and Markets)

Major banks like Wells Fargo and JPMorgan Chase have implemented voice recognition technology for customer authentication, improving security and reducing fraud. (Brain Hub)

Additionally, the integration of liveness detection in facial recognition systems has addressed concerns about spoofing attacks, with the liveness detection market projected to reach $4.4 billion by 2025 at a CAGR of 27.1%. (Facia)

Key Challenges Facing eKYC

While the eKYC (electronic Know Your Customer) industry is rapidly expanding and offers numerous benefits, such as improved efficiency and enhanced customer experience, it is not without its challenges.

Here are some of the key obstacles that businesses face when implementing eKYC systems:

Data Privacy and Security Concerns

One of the primary challenges in the eKYC market is ensuring data privacy and security while collecting and processing sensitive personal information.

With the implementation of stringent data protection regulations like GDPR in Europe and CCPA in California, companies face serious penalties for non-compliance.

For instance, British Airways was fined £20 million in 2020 for a data breach affecting 400,000 customers. (CNBC)

According to IBM's Cost of a Data Breach Report 2021, the average cost of a data breach in the financial sector reached $54.88 million.

This has led to increased investment in cybersecurity, with the global cybersecurity market in the financial services sector expected to grow from $74.3 billion in 2022 to $282 billion by 2032. (Allied Market Research)

Companies like Jumio have developed advanced encryption and data anonymization techniques to address these concerns, but the challenge remains consequential as cyber threats continue to advance.

Lack of Awareness

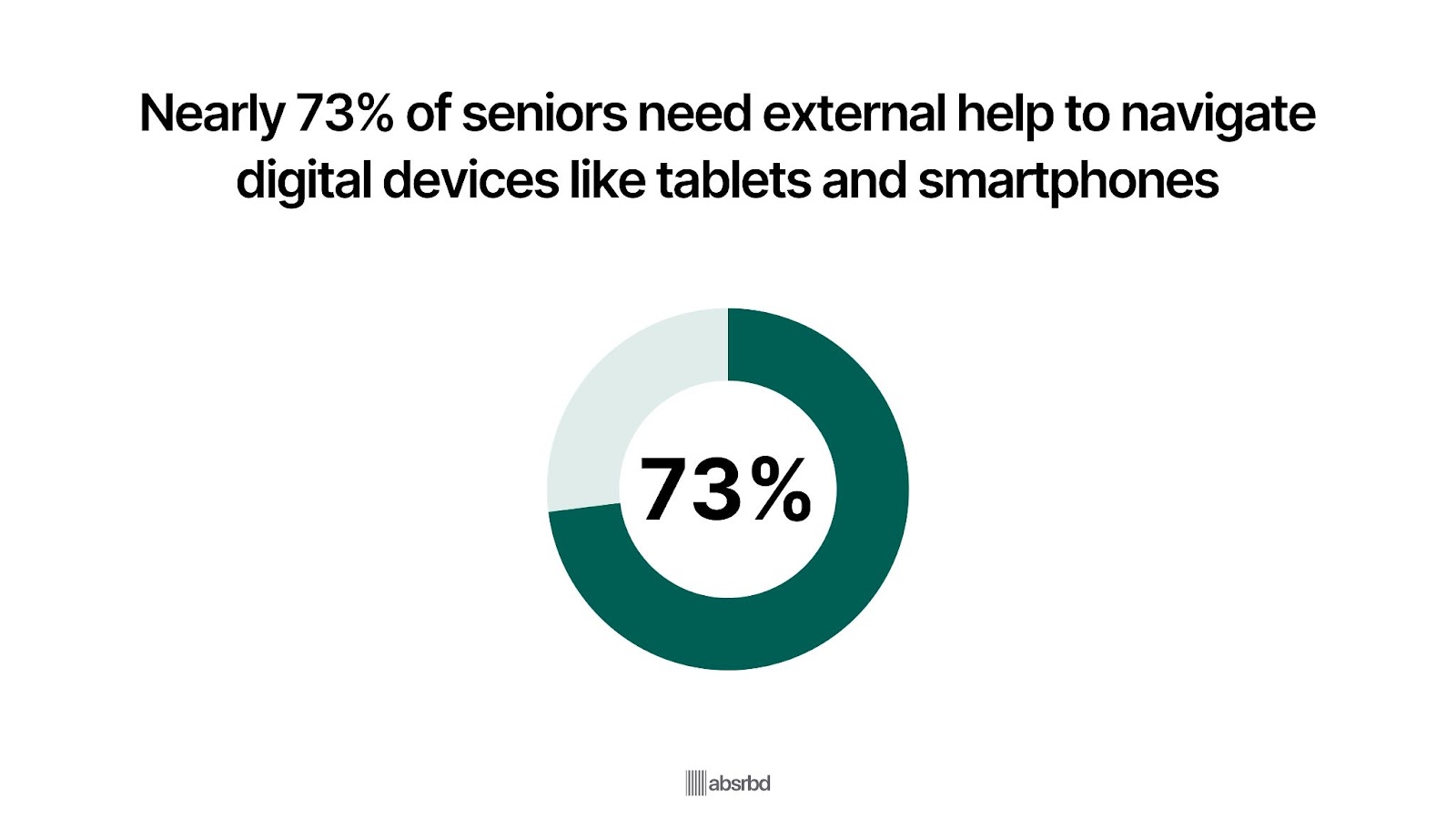

A key challenge in the eKYC market is the lack of awareness about its benefits, particularly among older populations.

A survey indicated that nearly 73% of seniors require external assistance to navigate digital devices like tablets and smartphones. (California Mobility)

This gap in understanding hinders the adoption of eKYC solutions, as many elderly individuals are accustomed to traditional paperwork methods.

The importance of this drift lies in the potential exclusion of a substantial demographic from digital services, which could lead to missed opportunities for financial institutions aiming to enhance customer engagement and streamline onboarding processes.

Technological Integration and Legacy Systems

The integration of eKYC solutions with existing legacy systems remains an uphill task for many financial institutions.

Many banks and financial services providers operate on outdated infrastructure that is not easily compatible with modern eKYC technologies.

According to a survey by Fenergo, 56% of C-suite executives in banks cite the cost and complexity of integrating with legacy systems as the biggest barrier to digital transformation. (FinTech Futures)

The global core banking software market, which includes the modernization of legacy systems, is expected to reach $34.48 billion by 2028, highlighting the scale of this challenge.

Fintech companies like Thought Machine are developing cloud-native core banking platforms to address this issue, but the transition remains complex and costly for many institutions.

Regulatory Compliance Across Different Jurisdictions

Navigating the complex and often conflicting regulatory framework across different jurisdictions presents a major challenge for eKYC providers and their clients.

Financial institutions operating globally must comply with diverse regulations such as the USA PATRIOT Act, the EU's 5AMLD, and China's Cybersecurity Law.

According to a Thomson Reuters survey, 84% of firms expect the focus on managing regulatory risk to increase. (KPMG)

This regulatory complexity has led to a surge in regulatory technology (RegTech) spending, with the global RegTech market expected to grow from $6.3 billion in 2020 to $16.0 billion by 2025. (PR Newswire)

Companies like ComplyAdvantage have developed AI-powered solutions to help navigate this regulatory maze, but keeping up with rapidly changing global regulations remains a serious challenge.

Balancing User Experience with Robust Verification

Striking a balance between a seamless user experience and thorough identity verification is a persistent challenge in the eKYC market.

While customers demand quick and frictionless onboarding processes, regulatory requirements often necessitate comprehensive checks.

According to a survey by Signicat, 63% of European consumers abandoned digital banking applications in 2020 due to lengthy onboarding processes. (Medium)

However, rushed verification can lead to increased fraud risks.

The abandonment rate for digital Onboarding in financial services is currently at 68%. (Signicat)

Companies like Onfido and Jumio are developing AI-powered solutions that aim to reduce verification times to under 15 seconds while maintaining accuracy, but achieving the right balance remains challenging as fraudsters become more sophisticated.

Handling Diverse Data Sources and Formats

eKYC systems must handle a wide variety of data sources and formats, from government-issued IDs to utility bills and social media profiles.

This diversity creates challenges in data standardization, validation, and analysis. According to the World Bank, over 1 billion people globally lack official proof of identity, further complicating the verification process.

The global data integration market, which addresses these challenges, is expected to grow from $11.6 billion in 2021 to $19.6 billion by 2026. (Markets and Markets)

Companies like Trulioo have developed global identity verification platforms that can access over 400 data sources worldwide, but integrating and making sense of this diverse data remains a major challenge, especially in emerging markets with limited digital infrastructure.

Emerging Opportunities in The eKYC Sector

These developments present new opportunities for businesses to leverage eKYC for enhanced efficiency, customer experience, and fraud prevention. Here are some of the emerging opportunities within this sector:

Increasing Mobile Penetration

The rise of mobile devices is creating substantial opportunities for eKYC solutions in the digital market.

With the eKYC market projected to grow at a CAGR of 21.55%, the increasing demand for mobile banking necessitates efficient identity verification.

Mobile applications enable users to complete onboarding processes seamlessly, with eKYC solutions automating document submissions through smartphones and tablets.

For instance, platforms like Revolut are using mobile eKYC to verify identities instantly, meeting customer expectations for speed and convenience.

Expansion into Non-Financial Sectors

While traditionally associated with financial institutions, eKYC is increasingly being adopted by non-financial sectors such as healthcare, telecom, and e-commerce.

For example, telecom companies are using eKYC for customer onboarding to comply with regulatory requirements, such as the TRAI mandate in India for SIM card registration. (mint)

In healthcare, eKYC can streamline patient onboarding, securely verify identities, and reduce administrative burdens.

According to a report by MarketsandMarkets, the global eKYC market in non-financial sectors is expected to grow exponentially, driven by the need for secure and efficient customer verification processes across various industries.

This expansion presents a lucrative opportunity for eKYC solution providers to diversify their client base.

Rise of Digital-Only Banks and Neobanks

The growth of digital-only banks and Neobanks is creating a substantial demand for efficient eKYC solutions.

These banks operate without physical branches, relying entirely on digital platforms to onboard customers.

For instance, neobanks like N26 and Revolut utilize eKYC to verify customer identities within minutes, providing a seamless user experience.

According to a report by Statista, the number of digital-only bank users worldwide is expected to grow from 197 million in 2020 to 217 million by 2025.

This surge in digital banking adoption presents a huge opportunity for eKYC solution providers to cater to a growing market segment focused on digital transformation and customer convenience.

Adoption of AI and Machine Learning

AI and machine learning technologies are transforming eKYC processes by improving the accuracy and efficiency of identity verification.

These technologies enable advanced data analytics, anomaly detection, and real-time decision-making, helping institutions identify fraudulent activities more effectively.

For example, AI can quickly cross-reference an applicant's data against a variety of sources to ensure authenticity.

According to Grand View Research, the AI market in identity verification is expected to grow at a CAGR of 22.3% from 2021, reaching $163 billion by 2033, driven by demand for automated and efficient KYC processes. (Market)

This represents a major opportunity for eKYC providers to develop more sophisticated and adaptive solutions.

Integration with Blockchain Technology

Blockchain technology offers a promising opportunity to enhance eKYC systems by providing secure, immutable, and transparent data verification.

This integration can help reduce redundancy and increase efficiency in KYC processes, as a verified identity on a blockchain can be reused across multiple platforms without repeated verification.

Projects like Sovrin and uPort are exploring decentralized identity solutions that allow users to control their own identity data, reducing the risks associated with centralized databases.

The blockchain identity management market is expected to grow from $1.3 billion in 2020 to $35.1 billion by 2028, reflecting growing interest in integrating blockchain with eKYC. (Markets and Markets)

Impact on Stakeholders

The emergence and adoption of eKYC technology have notable implications for a wide range of stakeholders, from consumers to financial institutions, regulatory bodies, and technology providers. Below is an overview of how eKYC impacts each group:

Financial Institutions

- Cost Reduction: According to a Thomson Reuters survey, financial firms report an 80% reduction in onboarding costs with eKYC implementation.

- Improved Compliance: eKYC helps institutions meet regulatory requirements more efficiently.

- Enhanced Customer Experience: Digital Onboarding reduces account opening times from days to minutes.

- Risk Mitigation: Advanced eKYC systems with AI capabilities help detect fraud more effectively.

Customers (Individual and Business)

- Convenience: Customers can now open accounts or access services remotely, anytime.

- Faster Onboarding: eKYC reduces onboarding time remarkably.

- Enhanced Security: Biometric verification in eKYC provides stronger security.

- Improved Access to Services: eKYC has made financial services more accessible, especially in underserved areas.

Regulators and Government Agencies

- Improved Oversight: Digital KYC records allow for better monitoring and auditing.

- Policy Development: eKYC has influenced regulatory policies.

- Reduced Financial Crime: eKYC helps in combating money laundering and terrorist financing.

Technology Providers

- Market Growth: The global eKYC market is expected to grow from $522 million in 2021 to $1.6 billion by 2026, according to MarketsandMarkets.

- Innovation Drive: Companies are constantly transforming to stay competitive.

- Partnerships: Tech providers are forming strategic partnerships.

Data Providers

- Increased Demand: There's a growing need for accurate and diverse data sources. - Data Quality Focus: Providers are investing in improving data accuracy and coverage.

- Privacy Concerns: Data providers face increased scrutiny over data handling practices.

Fintech Companies

- Rapid Growth: eKYC has enabled fintech companies to scale quickly.

- Competitive Advantage: Fintechs often have more agile eKYC processes than traditional banks. Regulatory Challenges: Fintechs must navigate complex regulatory environments.

End Consumers of Financial Services

- Wider Access to Financial Services: eKYC has made it easier for previously underbanked populations to access financial services.

- Improved User Experience: Consumers enjoy faster, more convenient financial services.

- Privacy Concerns: While benefiting from eKYC, consumers are also more aware of data privacy issues.

Conclusion

The swings in eKYC have far-reaching implications for various stakeholders.

For consumers, the promise of frictionless financial services is becoming a reality, with account opening times reduced from days to minutes.

Meanwhile, fintech startups must contend with the challenge of balancing rapid transformation with complex regulatory Compliance.

These shifts are driving a reevaluation of data privacy and security measures.

As cloud-based eKYC solutions gain global attention, we're likely to see a surge in cross-border collaborations and standardized verification protocols.

Moving forward, success in this space will hinge on achieving a delicate equilibrium between user convenience and robust security.

Those who can harness AI and machine learning to create adaptive, context-aware verification systems will be best positioned to thrive in the rapidly changing world of eKYC, redefining how we establish trust in the digital age.